Dish Network 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-27

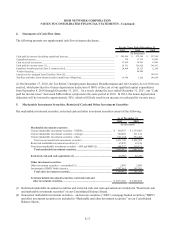

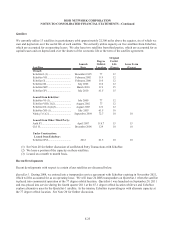

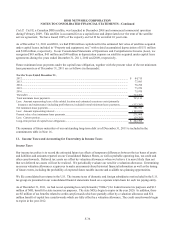

FCC Authorizations. We currently do not have any satellites positioned at the 148 degree orbital location as a result of

the retirement of EchoStar V. While we have requested the necessary approval from the FCC for the continued use of

this orbital location, there can be no assurance that the FCC will determine that our proposed future use of this orbital

location complies fully with all licensing requirements. If the FCC decides to revoke this license, we may be required to

write-off its $68 million carrying value.

8. 700 MHz Wireless Licenses

In 2008, we paid $712 million to acquire certain 700 MHz wireless licenses, which were granted to us by the FCC in

February 2009. To commercialize these licenses and satisfy the associated FCC build-out requirements, we will be

required to make significant additional investments or partner with others. Depending on the nature and scope of such

commercialization and build-out, any such investment or partnership could vary significantly. Part or all of these

licenses may be terminated if the associated FCC build-out requirements are not satisfied. In conducting our annual

impairment test in 2011, we determined that the estimated fair value of the FCC licenses, calculated using a market

based approach, exceeded their carrying amount. Based on this assessment, this asset was not impaired as of December

31, 2011.

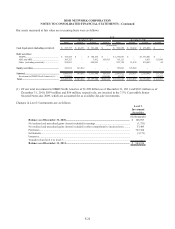

9. Acquisitions

When we acquire a business we recognize the assets acquired, liabilities assumed and any noncontrolling interests at fair

value. We expense all transaction costs related to the acquisition as incurred.

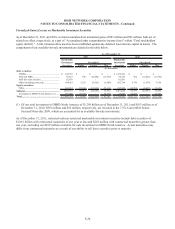

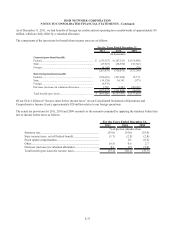

Blockbuster Acquisition

On April 26, 2011, we completed the Blockbuster Acquisition. We acquired Blockbuster operations in the United States

and in certain foreign countries. Our winning bid in the bankruptcy court auction was valued at $321 million. We paid

$238 million, including $226 million in cash and $12 million in certain assumed liabilities. Of the $226 million paid in

cash, $20 million was placed in escrow. Subsequent to this payment, we received a $4 million refund from escrow,

resulting in a net purchase price of $234 million. Blockbuster primarily offers movies and video games for sale and

rental through multiple distribution channels such as retail stores, by-mail, digital devices, the blockbuster.com website

and the BLOCKBUSTER On Demand service. The Blockbuster Acquisition complements our core business of

delivering high-quality video entertainment to consumers.

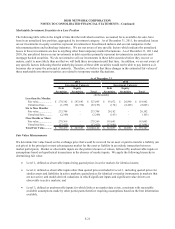

From the acquisition date of April 26, 2011 through December 31, 2011, Blockbuster operations contributed $975 million in

revenue and $4 million in net income to our consolidated results of operations. As of December 31, 2011, Blockbuster

operated over 1,500 retail stores in the United States. We expect to close over 500 domestic stores during the first half of

2012 as a result of weak store-level financial performance. Over 900 of our retail store leases, including the leases for the

majority of the stores we expect to close, include favorable early termination rights for us. We continue to evaluate the

impact of certain factors, including, among other things, competitive pressures, the scale of our Blockbuster retail

operations and other issues impacting the store-level financial performance of our Blockbuster retail stores. These

factors, or other reasons, could lead us to close additional Blockbuster retail stores.