Dish Network 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

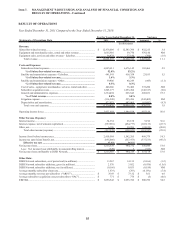

RESULTS OF OPERATIONS

48

48

You should read the following discussion and analysis of our financial condition and results of operations together

with the audited consolidated financial statements and notes to our financial statements included elsewhere in this

annual report. This management’s discussion and analysis is intended to help provide an understanding of our

financial condition, changes in financial condition and results of our operations and contains forward-looking

statements that involve risks and uncertainties. The forward-looking statements are not historical facts, but rather

are based on current expectations, estimates, assumptions and projections about our industry, business and future

financial results. Our actual results could differ materially from the results contemplated by these forward-looking

statements due to a number of factors, including those discussed in this report, including under the caption “Item

1A. Risk Factors” in this Annual Report on Form 10-K.

EXECUTIVE SUMMARY

Overview

DISH lost approximately 166,000 net subscribers during the year ended December 31, 2011, compared to a gain of

approximately 33,000 net new subscribers during the same period in 2010. The change versus the prior year

primarily resulted from a decline in gross new subscriber activations. During the year ended December 31, 2011,

DISH added approximately 2.576 million gross new subscribers compared to approximately 3.052 million gross

new subscribers during the same period in 2010, a decrease of 15.6%.

Our gross activations and net subscriber additions were negatively impacted during the year ended December 31,

2011 compared to the same period in 2010 as a result of increased competitive pressures, including aggressive

marketing and the effectiveness of certain competitors’ promotional offers, which included an increased level of

programming discounts. In addition, telecommunications companies continue to grow their respective customer

bases. Our gross activations and net subscriber additions continue to be adversely affected during the year ended

December 31, 2011 by sustained economic weakness and uncertainty, including, among other things, the weak

housing market in the United States combined with lower discretionary spending.

Our average monthly subscriber churn rate for the year ended December 31, 2011 was 1.63%, compared to 1.76%

for the same period in 2010. While churn improved compared to the same period in 2010, churn continues to be

adversely affected by the increased competitive pressures discussed above. In general, our churn rate is impacted by

the quality of subscribers acquired in past quarters, our ability to provide outstanding customer service, and our

ability to control piracy.

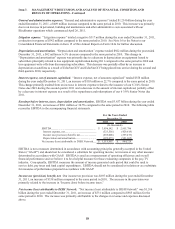

“Net income (loss) attributable to DISH Network” for the year ended December 31, 2011 was $1.516 billion

compared to $985 million for the same period in 2010. During the year ended December 31, 2011, “Net income

(loss) attributable to DISH Network” improved primarily due to a reduction in our accrued expenses related to the

TiVo Inc. settlement, price increases during the past year and less costs associated with fewer gross new subscriber

activations.

Programming costs represent a large percentage of our “Subscriber-related expenses.” Going forward, our margins

may face pressure if we are unable to renew our long-term programming contracts on favorable pricing and other

economic terms. Additionally, our gross new subscriber activations and subscriber churn rate may be negatively

impacted if we are unable to renew our long-term programming contracts before they expire.

As the pay-TV industry matures, we and our competitors increasingly must seek to attract a greater proportion of

new subscribers from each other’s existing subscriber bases rather than from first-time purchasers of pay-TV

services. Some of our competitors have been especially aggressive by offering discounted programming and

services for both new and existing subscribers. In addition, programming offered over the Internet has become more

prevalent as the speed and quality of broadband networks have improved. Significant changes in consumer behavior

with regard to the means by which they obtain video entertainment and information in response to digital media

competition could materially adversely affect our business, results of operations and financial condition or otherwise

disrupt our business.