Dish Network 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-19

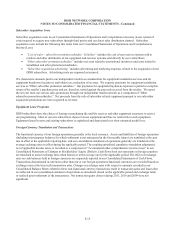

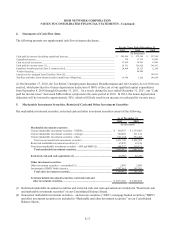

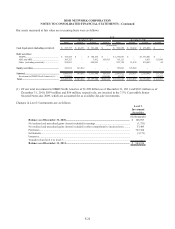

Fair Value Election. As of December 31, 2011 our ARS and MBS noncurrent marketable investment securities

portfolio of $109 million includes $63 million of securities accounted for under the fair value method. In March 2010,

the FASB issued Accounting Standards Update 2010-11 (“ASU 2010-11”), Derivatives and Hedging: Scope Exception

Related to Embedded Credit Derivatives. ASU 2010-11 clarifies the type of embedded credit derivative that is exempt from

certain bifurcation requirements. Only one form of embedded credit derivative qualifies for the exemption - one that is

related to the subordination of one financial instrument to another. As a result, entities that have contracts containing an

embedded credit derivative feature in a form other than subordination may need to separately account for the embedded

credit derivative feature. On July 1, 2010, we elected to apply the fair value option to certain of our ARS portfolio

impacted by ASU 2010-11. As a result, we recorded a $50 million loss, net of tax, which is included as a cumulative-

effect adjustment to “Accumulated earnings (deficit).” All changes in the fair value of these investments after June 30,

2010 are recognized in our results of operations and included in “Other, net” income and expense on our Consolidated

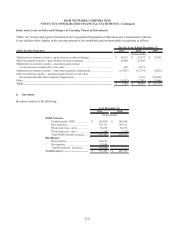

Statements of Operations and Comprehensive Income (Loss) and detailed in the table titled “Gains and Losses on Sales

and Changes in Carrying Value of Investments” below.

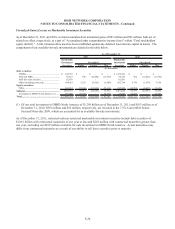

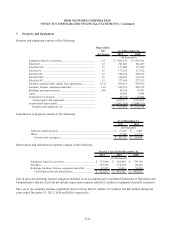

Other Investment Securities

We have a few strategic investments in certain debt and equity securities that are included in noncurrent “Marketable and

other investment securities” on our Consolidated Balance Sheets and accounted for using the cost, equity and/or fair value

methods of accounting.

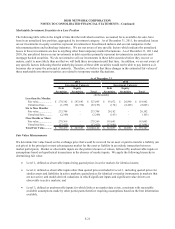

Our ability to realize value from our strategic investments in companies that are not publicly traded depends on the

success of those companies’ businesses and their ability to obtain sufficient capital to execute their business plans.

Because private markets are not as liquid as public markets, there is also increased risk that we will not be able to sell

these investments, or that when we desire to sell them we will not be able to obtain fair value for them.

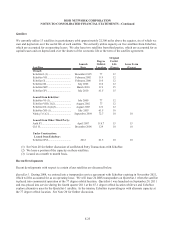

Investment in DBSD North America

Over the past several years, we have made various strategic investments in DBSD North America, a subsidiary of

Pendrell Corporation, formerly known as ICO Global Communications (Holdings) Limited (“ICO”). We have

committed, through various agreements described in Note 10, to acquire 100% of the equity of reorganized DBSD North

America for approximately $1.4 billion. As of December 31, 2011, our total investment in DBSD North America is

$1.298 billion and is included on our Consolidated Balance Sheets under the caption “Investment in DBSD North

America.”

All of our investments in DBSD North America are accounted for under the cost method of accounting, except for the

7.5% Convertible Senior Secured Notes due 2009, which are accounted for at fair value. The unrealized gains and

losses associated with the 7.5% Convertible Senior Secured Notes due 2009 are accounted for as a separate component

of “Accumulated other comprehensive income (loss)” within “Total stockholders’ equity (deficit)” on our Consolidated

Balance Sheets.