Dish Network 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

6

During the first half of 2011, we entered into a transaction to acquire 100% of the equity of reorganized DBSD

North America for approximately $1.4 billion upon DBSD North America’s emergence from bankruptcy, which

included capital stock and convertible securities of, and certain claims related to, DBSD North America. In

addition, in June 2011, we entered into the TerreStar Transaction for a purchase price of $1.375 billion. We have

paid all but $30 million of the purchase price for the TerreStar Transaction, which will be paid upon closing of the

TerreStar Transaction, or upon certain other conditions being met under the asset purchase agreement. Additionally,

during the fourth quarter 2011, we and Sprint entered into the Sprint Settlement Agreement pursuant to which all

disputed issues relating to our acquisition of DBSD North America and the TerreStar Transaction were resolved

between us and Sprint, including, but not limited to, issues relating to costs allegedly incurred by Sprint to relocate

users from the spectrum now licensed to DBSD North America and TerreStar. Pursuant to the Sprint Settlement

Agreement, we made a net payment of approximately $114 million to Sprint. Our ultimate acquisition of 100% of

the equity of reorganized DBSD North America and consummation of the TerreStar Transaction are subject to

certain conditions, including approval by the FCC.

Under our agreements to acquire DBSD North America and purchase TerreStar’s assets, we paid substantially all of

the purchase price for both transactions prior to the receipt of certain regulatory approvals (the FCC with respect to

DBSD North America, and the FCC and the Canadian federal Department of Industry (“Industry Canada”) with

respect to TerreStar). On February 7, 2012, Industry Canada approved the transfer of the Canadian spectrum

licenses held by TerreStar to us. If the remaining required approvals are not obtained, subject to certain exceptions,

we have the right to require and direct the sale of some or all of the assets of the relevant company to a third party

and we would be entitled to the proceeds from such a sale. These proceeds could, however, be substantially less

than amounts we have paid in the respective transactions.

In addition, our consolidated FCC applications for approval of the license transfers from DBSD North America and

TerreStar were accompanied by requests for waiver of the integrated service requirement, the spare satellite

requirement and various technical provisions. Waiver of the integrated service requirement would allow DISH to

offer single-mode terrestrial terminals to customers who do not desire satellite functionality. The spectrum licenses

currently held by DBSD North America and TerreStar do not include a waiver of this integrated service

requirement. Our integrated service requirement waiver request has been opposed by certain parties, and there can

be no assurance that the FCC will approve it. If our FCC applications and waiver requests are not granted by the

FCC, or are granted in a manner that varies from the form we have requested, it could cause the value of these assets

to be impaired, potentially requiring us to take significant write-downs on these assets. We assess potential

impairments to these assets annually, or more often if indicators of impairment arise, to determine whether an

impairment condition may exist. We use a probability weighted analysis considering estimated future cash flows

discounted at a rate commensurate with the risk involved and market based data to assess potential impairments.

To the extent we receive these approvals and waivers, there can be no assurance that we will be able to develop and

implement a business model that will realize a return on these spectrum investments or that we will be able to

profitably deploy the assets represented by these spectrum investments. We will likely be required to make

significant additional investments or partner with others to commercialize these licenses. Because we have not

received approval from the FCC, we do not yet know the full costs (including any build-out requirements)

associated with complying with regulations applicable to our acquisition of DBSD North America or the TerreStar

Transaction. Depending on the nature and scope of such commercialization and build-out, any such investment or

partnership could vary significantly, which may affect the carrying value of our investments and our future financial

condition or results of operations.

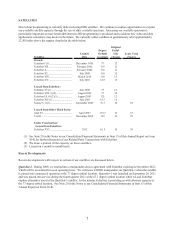

Transactions with EchoStar

On January 1, 2008, we completed the distribution of our technology and set-top box business and certain

infrastructure assets (the “Spin-off”) into a separate publicly-traded company, EchoStar. DISH Network and

EchoStar operate as separate publicly-traded companies, and neither entity has any ownership interest in the other.

However, a substantial majority of the voting power of the shares of both DISH Network and EchoStar is owned

beneficially by Charles W. Ergen, our Chairman, or by certain trusts established by Mr. Ergen for the benefit of his

family.