Dish Network 2000 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–26

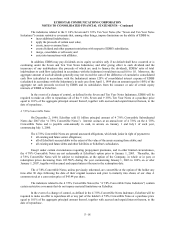

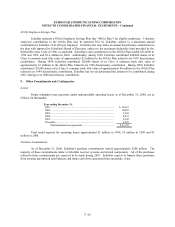

401(k) Employee Savings Plan

EchoStar sponsors a 401(k) Employee Savings Plan (the “401(k) Plan”) for eligible employees. Voluntary

employee contributions to the 401(k) Plan may be matched 50% by EchoStar, subject to a maximum annual

contribution by EchoStar of $1,000 per employee. EchoStar also may make an annual discretionary contribution to

the plan with approval by EchoStar’s Board of Directors, subject to the maximum deductible limit provided by the

Internal Revenue Code of 1986, as amended. EchoStar’s cash contributions to the 401(k) Plan totaled $314,000 in

1998 and 1999, and $1.6 million in 2000. Additionally, during 1998, EchoStar contributed 640,000 shares of its

Class A common stock (fair value of approximately $2 million) to the 401(k) Plan related to its 1997 discretionary

contribution. During 1999, EchoStar contributed 520,000 shares of its Class A common stock (fair value of

approximately $3 million) to the 401(k) Plan related to its 1998 discretionary contribution. During 2000, EchoStar

contributed 120,000 shares of its Class A common stock (fair value of approximately $6 million) to the 401(k) Plan

related to its 1999 discretionary contribution. EchoStar has not yet determined the amount to be contributed during

2001 relating to its 2000 discretionary contribution.

9. Other Commitments and Contingencies

Leases

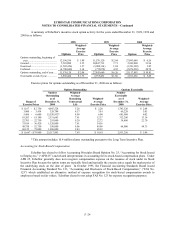

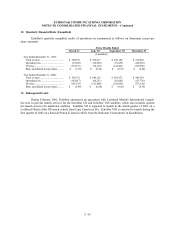

Future minimum lease payments under noncancelable operating leases as of December 31, 2000, are as

follows (in thousands):

Year ending December 31,

2001 ............................................................................................. $ 10,627

2002 ............................................................................................. 10,407

2003 ............................................................................................. 9,369

2004 ............................................................................................. 4,032

2005 ............................................................................................. 2,245

Thereafter ..................................................................................... 4,505

Total minimum lease payments............................................... $ 41,185

Total rental expense for operating leases approximated $1 million in 1998, $3 million in 1999 and $5

million in 2000.

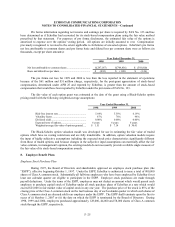

Purchase Commitments

As of December 31, 2000, EchoStar’s purchase commitments totaled approximately $204 million. The

majority of these commitments relate to EchoStar receiver systems and related components. All of the purchases

related to these commitments are expected to be made during 2001. EchoStar expects to finance these purchases

from existing unrestricted cash balances and future cash flows generated from operations, if any.