Dish Network 2000 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

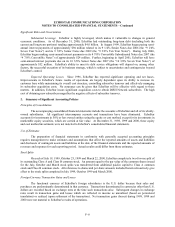

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–12

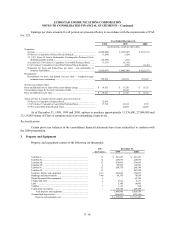

Revenue Recognition

Revenue from the provision of DISH Network subscription television services and satellite services is

recognized as revenue in the period such services are provided. Revenue from sales of digital set-top boxes and

related accessories is recognized upon shipment to customers. Revenue from the provision of integration services is

recognized as revenue in the period the services are performed.

In December 1999, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 101 or

SAB 101, “Views on Selected Revenue Recognition Issues.” SAB 101 provides guidance on applying generally

accepted accounting principles to selected revenue recognition issues. The provisions of SAB 101 and certain

related EITF consensuses were required to be adopted in the quarter ended December 31, 2000 retroactive to

January 1, 2000, with any cumulative effect as of January 1, 2000 reported as a cumulative effect of a change in

accounting principle. EchoStar’s adoption of SAB 101 resulted in no recognition of a cumulative effect of a change

in accounting principle.

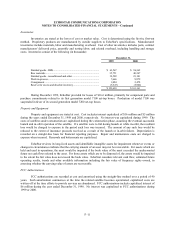

Subscriber Promotion Subsidies and Subscriber Acquisition Costs

Subscriber promotion subsidies – promotional DTH equipment includes the cost of Echostar receiver

systems distributed to retailers and other distributors of Echostar’s equipment. Subscriber promotion subsidies –

other includes net costs related to various installation promotions and other promotional incentives. Accordingly,

subscriber acquisition costs are generally expensed as incurred except for under EchoStar’s Digital Dynamite Plan

which was initiated during 2000 wherein the Company retains title to the receiver system equipment resulting in the

capitalization and depreciation of such equipment over its estimated useful life.

Deferred Debt Issuance Costs and Debt Discount

Costs of issuing debt are deferred and amortized to interest expense over the terms of the respective notes.

Deferred Revenue

Deferred revenue principally consists of prepayments received from subscribers for DISH Network

programming. Such amounts are recognized as revenue in the period the programming is provided to the subscriber.

Long-Term Deferred Distribution and Carriage Revenue

Long-term deferred distribution and carriage revenue consists of advance payments from certain content

providers for carriage of their signal on the DISH Network. Such amounts are deferred and recognized as revenue

on a straight-line basis over the related contract terms (up to ten years).