Dish Network 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Satellite Dealers Supply, Inc. filed a lawsuit on September 25, 2000, on behalf of itself and a class of

persons similarly situated. The plaintiff is attempting to certify a nationwide class allegedly brought on behalf of

sellers, installers, and servicers of equipment used to provide satellite, who contract with the us and claims the

alleged class has been “subject to improper chargebacks.” The plaintiff alleges that (1) we charged back certain fees

paid by members of the class to professional installers in violation of contractual terms; (2) we manipulated the

accounts of subscribers to deny payments to class members; and (3) we misrepresented to class members who owns

certain equipment related to the provision of satellite television services. The plaintiff is requesting a permanent

injunction and monetary damages. We intend to vigorously defend the lawsuit and to assert a variety of

counterclaims. It is too early to make an assessment of the probable outcome of the litigation or to determine the

extent of any potential liability or damages.

We are subject to various other legal proceedings and claims which arise in the ordinary course of business.

In the opinion of management, the amount of ultimate liability with respect to those actions will not materially affect

our financial position or results of operations.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No items were submitted to a vote of security holders during the fourth quarter of 2000.

PART II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER

MATTERS

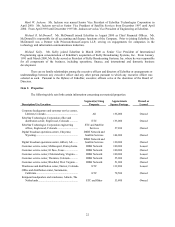

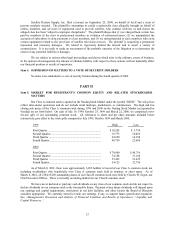

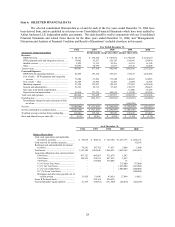

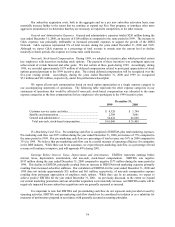

Our Class A common stock is quoted on the Nasdaq Stock Market under the symbol “DISH.” The sale prices

reflect inter-dealer quotations and do not include retail markups, markdowns, or commissions. The high and low

closing sale prices of the Class A common stock during 1999 and 2000 on the Nasdaq Stock Market (as reported by

Nasdaq) are set forth below. On each of July 19, 1999, October 25, 1999 and March 22, 2000, we completed a two-

for-one split of our outstanding common stock. All references to share and per share amounts included below

retroactively give effect to the stock splits competed in July 1999, October 1999 and March 2000.

1999 High Low

First Quarter....................................................................... $ 10.203 $ 5.750

Second Quarter................................................................... 19.773 10.063

Third Quarter ..................................................................... 24.250 14.188

Fourth Quarter.................................................................... 48.750 22.484

2000

First Quarter....................................................................... $ 79.000 $ 40.719

Second Quarter................................................................... 74.188 31.188

Third Quarter ..................................................................... 53.422 31.625

Fourth Quarter.................................................................... 54.125 22.750

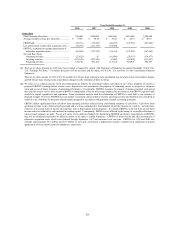

As of March 8, 2001, there were approximately 3,659 holders of record of our Class A common stock, not

including stockholders who beneficially own Class A common stock held in nominee or street name. As of

March 8, 2001, all 238,435,208 outstanding shares of our Class B common stock were held by Charles W. Ergen, our

Chief Executive Officer. There is currently no trading market for our Class B common stock.

We have never declared or paid any cash dividends on any class of our common stock and do not expect to

declare dividends on our common stock in the foreseeable future. Payment of any future dividends will depend upon

our earnings and capital requirements, restrictions in our debt facilities, and other factors the Board of Directors

considers appropriate. We currently intend to retain our earnings, if any, to support future growth and expansion.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and

Capital Resources.”