Dish Network 2000 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–23

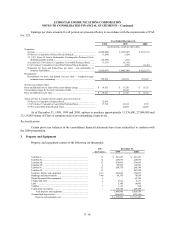

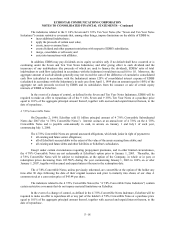

However, as of December 31, 2000, approximately 2.1 million shares of Series C Preferred Stock have been

converted into approximately 34.2 million shares of EchoStar’s class A common stock, reducing the book value of

the Series C Preferred Stock to approximately $11 million. The Deposit Account provided quarterly cash payments

of approximately $0.844 per share of Series C Preferred Stock, from February 1, 1998 until November 1, 1999.

On November 2, 1999, dividends on the Series C Preferred Stock began to accrue. Each share of Series C

Preferred Stock has a liquidation preference of $50 per share. Holders of the Series C Preferred Stock are entitled to

receive cumulative dividends at an annual rate of 6 3/4% of the liquidation preference, payable quarterly in arrears

commencing February 1, 2000, or upon conversion. Dividends may, at the option of EchoStar, be paid in cash, by

delivery of fully paid and nonassessable shares of Class A common stock, or a combination thereof. Each share of

Series C Preferred Stock is convertible at any time, unless previously redeemed, at the option of the holder thereof,

into approximately 16.4 shares of Class A common stock, subject to adjustment upon the occurrence of certain

events. The Series C Preferred Stock is redeemable at any time on or after November 1, 2000, in whole or in part, at

the option of EchoStar, in cash, by delivery of fully paid and nonassessable shares of Class A common stock, or a

combination thereof, initially at a price of $51.929 per share and thereafter at prices declining to $50.000 per share

on or after November 1, 2004, plus in each case all accumulated and unpaid dividends to the redemption date.

7. Stock Compensation Plans

Stock Incentive Plan

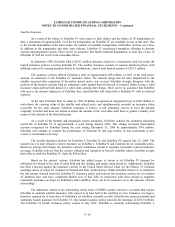

In April 1994, EchoStar adopted a stock incentive plan to provide incentive to attract and retain officers,

directors and key employees. EchoStar currently has reserved up to 80 million shares of its Class A common stock

for granting awards under its 1995 Stock Incentive Plan and an additional 80 million shares of its Class A common

stock for granting awards under its 1999 Stock Incentive Plan. In general, stock options granted through

December 31, 2000 have included exercise prices not less than the fair market value of EchoStar’s Class A common

stock at the date of grant, and vest, as determined by EchoStar’s Board of Directors, generally at the rate of 20% per

year.

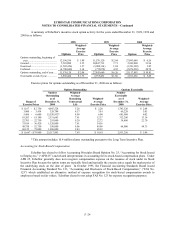

During 1999, EchoStar adopted the 1999 Incentive Plan which provided certain key employees a

contingent incentive including stock options and cash. The payment of these incentives was contingent upon the

achievement of certain financial and other goals of EchoStar. EchoStar met certain of these goals during 1999.

Accordingly, in 1999, EchoStar recorded approximately $179 million of deferred compensation related to post-grant

appreciation of options to purchase approximately 4.2 million shares, granted pursuant to the 1999 Incentive Plan.

The related deferred compensation will be recognized over the five-year vesting period. During the year ended

December 31, 1999 and 2000, EchoStar recognized $61 million and $51 million, respectively, under the 1999

Incentive Plan. The remainder will be recognized over the remaining vesting period.

Options to purchase an additional 11.2 million shares were granted at fair market value during 1999

pursuant to the Long Term Incentive Plan. Vesting of these options is contingent on meeting certain longer-term

goals, the achievement of which can not be reasonably predicted as of December 31, 2000. Accordingly, no

compensation was recorded during 1999 and 2000 related to these long-term options. EchoStar will continue to

evaluate the likelihood of achieving these long-term goals and will record the related compensation at the time

achievement of these goals becomes probable. During 2000, the Board of Directors approved a 2000 Incentive Plan.

The payment of these incentives was contingent upon the achievement of certain financial and other goals of

EchoStar. EchoStar did not meet any of these goals in 2000. Accordingly, no cash incentives were paid and all

stock options granted pursuant to the 2000 Incentive Plan were cancelled.