Dish Network 2000 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

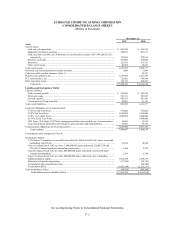

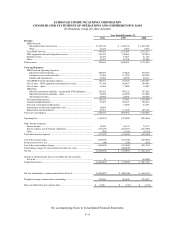

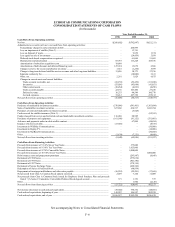

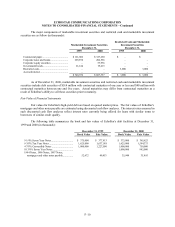

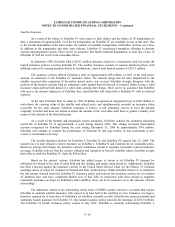

ECHOSTAR COMMUNICATIONS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

See accompanying Notes to Consolidated Financial Statements.

F–6

Year Ended December 31,

1998 1999 2000

Cash Flows From Operating Activities:

Net loss........................................................................................................................................................ $(260,882) $(792,847) $(621,211)

Adjustments to reconcile net loss to net cash flows from operating activities:

Extraordinary charge for early retirement of debt ................................................................................. –268,999 –

Loss on impairment of satellite (Note 3) ............................................................................................... –13,741 –

Loss on disposal of assets....................................................................................................................... –9,852 1,374

Loss (gain) on sale of investments ......................................................................................................... –(24,439) 3,039

Deferred stock-based compensation recognized.................................................................................... –61,060 51,465

Depreciation and amortization............................................................................................................... 83,767 113,228 185,356

Amortization of subscriber acquisition costs ......................................................................................... 18,869 – –

Amortization of debt discount and deferred financing costs ................................................................. 125,724 13,678 6,506

Change in reserve for excess and obsolete inventory ............................................................................ 1,341 (1,234) 5,959

Change in long-term deferred satellite services revenue and other long-term liabilities ...................... 13,856 10,173 37,236

Superstar exclusivity fee......................................................................................................................... –(10,000) 3,611

Other, net ................................................................................................................................................ 2,291 1,829 6,875

Changes in current assets and current liabilities:

Trade accounts receivable, net........................................................................................................... (41,159) (52,452) (111,898)

Inventories.......................................................................................................................................... (55,056) (45,688) (41,851)

Other current assets............................................................................................................................ (10,264) (4,091) (8,296)

Trade accounts payable ..................................................................................................................... 22,136 103,400 27,250

Deferred revenue ............................................................................................................................... 10,275 48,549 100,776

Accrued expenses .............................................................................................................................. 72,212 227,729 235,132

Net cash flows from operating activities .................................................................................................... (16,890) (58,513) (118,677)

Cash Flows From Investing Activities:

Purchases of marketable investment securities........................................................................................... (570,096) (541,401) (1,363,884)

Sales of marketable investment securities .................................................................................................. 627,860 434,517 1,041,784

Purchases of restricted marketable investment securities........................................................................... –(5,928) –

Cash reserved for satellite insurance (Note 3)............................................................................................ – – (82,393)

Funds released from escrow and restricted cash and marketable investment securities............................ 116,468 80,585 –

Purchases of property and equipment......................................................................................................... (161,140) (91,152) (331,401)

Advances and payments under in-orbit satellite contract........................................................................... –67,804 (48,894)

Issuance of notes receivable........................................................................................................................ (17,666) –(8,675)

Investment in Wildblue Communications. ................................................................................................. – – (50,000)

Investment in Replay TV............................................................................................................................ – – (10,000)

Investment in StarBand Communications .................................................................................................. – – (50,045)

Other............................................................................................................................................................ (3,474) (7,251) (8,449)

Net cash flows from investing activities..................................................................................................... (8,048) (62,826) (911,957)

Cash Flows From Financing Activities:

Proceeds from issuance of 9 1/4% Seven Year Notes................................................................................ –375,000 –

Proceeds from issuance of 9 3/8% Ten Year Notes ................................................................................... –1,625,000 –

Proceeds from issuance of 4 7/8% Convertible Notes ............................................................................... –1,000,000 –

Proceeds from issuance of 10 3/8% Seven Year Notes.............................................................................. – – 1,000,000

Debt issuance costs and prepayment premiums ......................................................................................... –(293,987) (9,645)

Retirement of 1994 Notes ........................................................................................................................... –(575,674) –

Retirement of 1996 Notes ........................................................................................................................... –(501,350) –

Retirement of 1997 Notes ........................................................................................................................... –(378,110) –

Retirement of Senior Exchange Notes........................................................................................................ –(228,528) –

Redemption of Series A Preferred Stock.................................................................................................... –(90,934) –

Repayments of mortgage indebtedness and other notes payable ............................................................... (16,552) (22,201) (17,668)

Net proceeds from Class A Common Stock options exercised.................................................................. 2,459 7,164 11,009

Net proceeds from Class A Common Stock issued for Employee Stock Purchase Plan and proceeds

from 6 3/4% Series C Cumulative Convertible Preferred Stock deposit account .................................. 371 1,751 577

Other............................................................................................................................................................ –1,960 (2,120)

Net cash flows from financing activities .................................................................................................... (13,722) 920,091 982,153

Net increase (decrease) in cash and cash equivalents................................................................................. (38,660) 798,752 (48,481)

Cash and cash equivalents, beginning of year............................................................................................ 145,207 106,547 905,299

Cash and cash equivalents, end of year ...................................................................................................... $ 106,547 $ 905,299 $ 856,818