Dish Network 2000 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

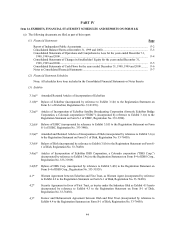

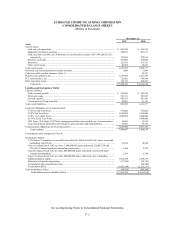

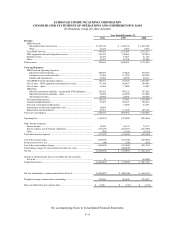

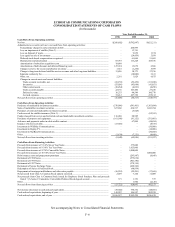

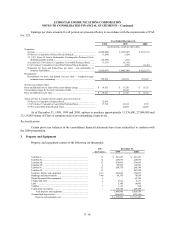

ECHOSTAR COMMUNICATIONS CORPORATION

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

(In thousands, except per share amounts)

See accompanying Notes to Consolidated Financial Statements.

F–5

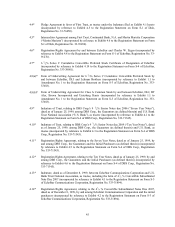

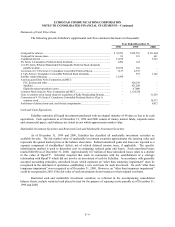

Deferred

Stock-

Accumulated

Deficit and

Common Stock

Series A

Preferred

Series C

Preferred

Based

Compen-

Additional

Paid-In

Unrealized

Holding Gains

Shares Amt. Stock Stock Sation Capital (Losses) Total

Balance, December 31, 1997 ........................................... 358,480 $3,585 $ 19,603 $ 101,529 $ – $ 223,337 $ (437,015) $ (88,961)

Series A Preferred Stock dividends (at $0.75 per

share)........................................................................ – – 1,204 – – – (1,204) –

Series B Preferred Stock dividends payable in-kind.... – – – – – – (26,874) (26,874)

Accretion of Series C Preferred Stock......................... – – – 7,137 – – (7,137) –

Issuance of Class A Common Stock:

Exercise of stock options........................................ 1,568 16 – – – 2,480 –2,496

Employee benefits................................................... 800 8 – – – 2,283 –2,291

Employee Stock Purchase Plan.............................. 128 – – – – 371 – 371

Unrealized holding gains on available-for-sale

securities, net........................................................... – – – – – – 19 19

Net loss......................................................................... – – – – – – (260,882) (260,882)

Balance, December 31, 1998 ........................................... 360,976 3,609 20,807 108,666 –228,471 (733,093) (371,540)

Series A Preferred Stock dividends (at $0.75 per

share)........................................................................ – – 124 – – – (124) –

Retirement of Series A Preferred Stock....................... – – (20,931) – – – (70,003) (90,934)

Series B Preferred Stock dividends payable in-kind.... – – – – – – (241) (241)

Accretion of Series C Preferred Stock......................... – – – 6,335 – – (6,335) –

Series C Preferred Stock dividends (at $0.84375 per

share, per quarter) .................................................... – – – – – – (553) (553)

Conversion of Series C Preferred Stock..................... 22,832 228 – (69,567) –69,339 – –

Proceeds from Series C Preferred Stock deposit

account..................................................................... 46 – – – – 953 2 955

Issuance of Class A Common Stock:

Acquisition of Media4............................................ 1,376 14 – – – 9,593 –9,607

News Corporation and MCI transaction................ 68,824 688 – – – 1,123,632 –1,124,320

Exercise of stock options........................................ 3,868 39 – – – 7,125 –7,164

Employee benefits................................................... 556 6 – – – 3,789 –3,795

Employee Stock Purchase Plan.............................. 44 – – – – 796 – 796

Deferred stock-based compensation........................... – – – – (178,840) 178,840 – –

Deferred stock-based compensation recognized ....... – – – – 61,060 –61,060

Net loss......................................................................... – – – – – – (792,847) (792,847)

Balance, December 31, 1999 ........................................... 458,522 4,584 –45,434 (117,780) 1,622,538 (1,603,194) (48,418)

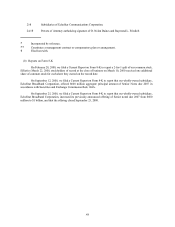

Series C Preferred Stock dividends (at $0.84375 per

share, per quarter) .................................................... – – – – – – (1,146) (1,146)

Conversion of Series C Preferred Stock..................... 11,320 113 – (34,486) –34,373 – –

Issuance of Class A Common Stock:

Acquisition of Kelly Broadcasting Systems ......... 510 5 – – – 31,551 –31,556

Exercise of stock options........................................ 3,593 36 – – – 10,973 –11,009

Employee benefits................................................... 182 2 – – – 7,282 –7,284

Employee Stock Purchase Plan.............................. 58 1 – – – 1,722 –1,723

Forfeitures of deferred non-cash, stock-based

compensation........................................................... – – – – 6,730 (8,072) –(1,342)

Deferred stock-based compensation recognized ....... – – – – 52,857 – – 52,857

Unrealized holding gains on available-for-sale

securities, net........................................................... – – – – – – (60,580) (60,580)

Net loss......................................................................... – – – – – – (621,211) (621,211)

Balance, December 31, 2000 ........................................... 474,185 $ 4,741 $ – $ 10,948 $(58,193) $1,700,367 $ (2,286,131) $(628,268)