Dish Network 2000 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–22

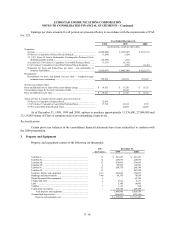

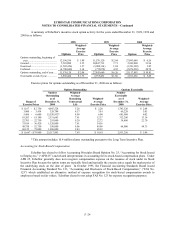

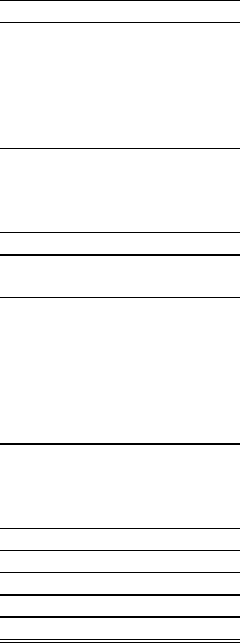

The temporary differences, which give rise to deferred tax assets and liabilities as of December 31, 1999

and 2000, are as follows (in thousands):

December 31,

1999 2000

Current deferred tax assets:

Accrued royalties ................................................................................. $ 30,018 $ 36,425

Inventory reserves and cost methods...................................................... 1,380 3,974

Accrued expenses................................................................................. 29,846 40,685

Allowance for doubtful accounts ........................................................... 5,636 12,533

Reserve for warranty costs .................................................................... 78 79

Total current deferred tax assets................................................................ 66,958 93,696

Current deferred tax liabilities:

Other................................................................................................... (68) (40)

Total current deferred tax liabilities........................................................... (68) (40)

Gross current deferred tax assets ............................................................... 66,890 93,656

Valuation allowance................................................................................. (55,162) (79,023)

Net current deferred tax assets .................................................................. 11,728 14,633

Noncurrent deferred tax assets:

General business and foreign tax credits................................................. 2,504 2,504

Net operating loss carryforwards ........................................................... 528,961 771,748

Incentive plan stock compensation......................................................... 22,600 38,841

Other................................................................................................... 9,553 23,802

Total noncurrent deferred tax assets .......................................................... 563,618 836,895

Noncurrent deferred tax liabilities:

Depreciation ........................................................................................ (43,459) (77,452)

Other................................................................................................... (425) (1,108)

Total noncurrent deferred tax liabilities ..................................................... (43,884) (78,560)

Gross deferred tax assets .......................................................................... 519,734 758,335

Valuation allowance................................................................................. (464,327) (705,833)

Net noncurrent deferred tax assets............................................................. 55,407 52,502

Net deferred tax assets.............................................................................. $ 67,135 $ 67,135

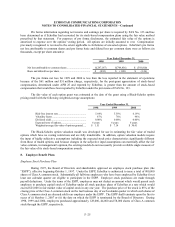

6. Stockholders’ Equity (Deficit)

Common Stock

The Class A, Class B and Class C common stock are equivalent in all respects except voting rights.

Holders of Class A and Class C common stock are entitled to one vote per share and holders of Class B common

stock are entitled to ten votes per share. Each share of Class B and Class C common stock is convertible, at the

option of the holder, into one share of Class A common stock. Upon a change in control of ECC, each holder of

outstanding shares of Class C common stock is entitled to ten votes for each share of Class C common stock held.

ECC’s principal stockholder owns all outstanding Class B common stock and all other stockholders own Class A

common stock. There are no shares of Class C common stock outstanding.

Series C Cumulative Convertible Preferred Stock

In November 1997, EchoStar issued 2.3 million shares of 6 3/4% Series C Cumulative Convertible

Preferred Stock (the “Series C Preferred Stock”) which resulted in net proceeds to EchoStar of approximately $97

million. Simultaneous with the issuance of the Series C Preferred Stock, the purchasers of the Series C Preferred

Stock placed approximately $15 million into an account (the “Deposit Account”). EchoStar recorded proceeds from

the issuance of the Series C Preferred Stock net of the amount placed in the Deposit Account. As of November 2,

1999, proceeds from the issuance of the Series C Preferred Stock were accreted to the face amount of $115 million.