Dish Network 2000 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–11

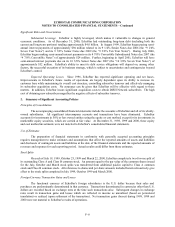

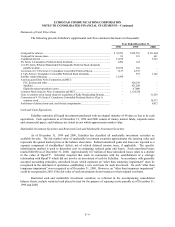

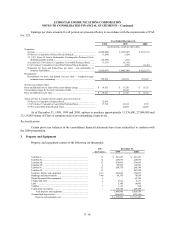

Inventories

Inventories are stated at the lower of cost or market value. Cost is determined using the first-in, first-out

method. Proprietary products are manufactured by outside suppliers to EchoStar’s specifications. Manufactured

inventories include materials, labor and manufacturing overhead. Cost of other inventories includes parts, contract

manufacturers’ delivered price, assembly and testing labor, and related overhead, including handling and storage

costs. Inventories consist of the following (in thousands):

December 31,

1999 2000

Finished goods - DBS................................................................... $ 63,567 $ 96,362

Raw materials .............................................................................. 35,751 40,247

Finished goods - reconditioned and other ....................................... 19,509 23,101

Work-in-process........................................................................... 7,666 8,879

Consignment................................................................................ 1,084 2,478

Reserve for excess and obsolete inventory...................................... (3,947) (9,906)

$ 123,630 $ 161,161

During December 1999, EchoStar provided for losses of $16.6 million, primarily for component parts and

purchase commitments related to its first generation model 7100 set-top boxes. Production of model 7100 was

suspended in favor of its second generation model 7200 set-top boxes.

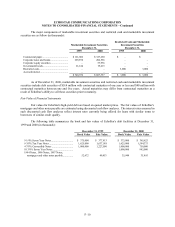

Property and Equipment

Property and equipment are stated at cost. Cost includes interest capitalized of $16 million and $5 million

during the years ended December 31, 1998 and 2000, respectively. No interest was capitalized during 1999. The

costs of satellites under construction are capitalized during the construction phase, assuming the eventual successful

launch and in-orbit operation of the satellite. If a satellite were to fail during launch or while in-orbit, the resultant

loss would be charged to expense in the period such loss was incurred. The amount of any such loss would be

reduced to the extent of insurance proceeds received as a result of the launch or in-orbit failure. Depreciation is

recorded on a straight-line basis for financial reporting purposes. Repair and maintenance costs are charged to

expense when incurred. Renewals and betterments are capitalized.

EchoStar reviews its long-lived assets and identifiable intangible assets for impairment whenever events or

changes in circumstances indicate that the carrying amount of an asset may not be recoverable. For assets which are

held and used in operations, the asset would be impaired if the book value of the asset exceeded the undiscounted

future net cash flows related to the asset. For those assets which are to be disposed of, the assets would be impaired

to the extent the fair value does not exceed the book value. EchoStar considers relevant cash flow, estimated future

operating results, trends and other available information including the fair value of frequency rights owned, in

assessing whether the carrying value of assets are recoverable.

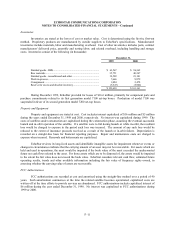

FCC Authorizations

FCC authorizations are recorded at cost and amortized using the straight-line method over a period of 40

years. Such amortization commences at the time the related satellite becomes operational; capitalized costs are

written off at the time efforts to provide services are abandoned. FCC authorizations include capitalized interest of

$6 million during the year ended December 31, 1998. No interest was capitalized to FCC authorizations during

1999 or 2000.