Dish Network 2000 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

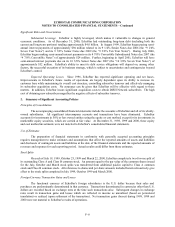

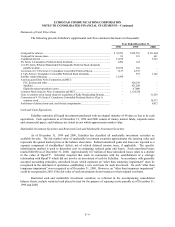

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–17

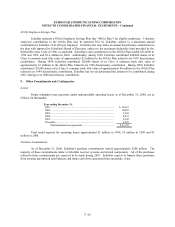

EchoStar II, EchoStar III, EchoStar IV and EchoStar V. To satisfy insurance covenants related to the outstanding

EDBS senior notes, as of December 31, 2000, EchoStar has reclassified approximately $82 million from cash and

cash equivalents to restricted cash and marketable investment securities on its balance sheet. The reclassification

will continue until such time, if ever, as the insurers are again willing to insure EchoStar’s satellites on

commercially reasonable terms.

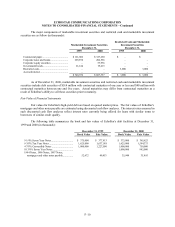

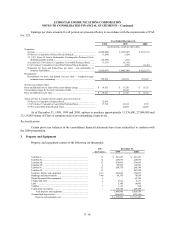

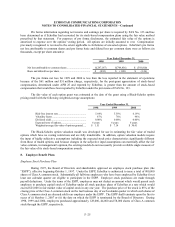

4. Long-Term Debt

Debt Redemption

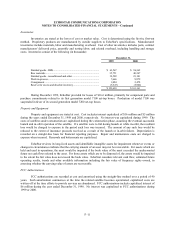

Effective July 14, 2000, we redeemed all of our remaining outstanding 12 7/8% Senior Secured Discount

Notes Due 2004 (the “1994 Notes”), 13 1/8% Senior Secured Discount Notes due 2004 (the “1996 Notes”), 12 1/2%

Senior Secured Notes due 2002 (the “1997 Notes”) and 12 1/8% Senior Exchange Notes Due 2004 (the “Exchange

Notes”) totaling approximately $2.6 million.

9 1/4% Seven and 9 3/8% Ten Year Notes

On January 25, 1999, EDBS sold $375 million principal amount of 9 1/4% Senior Notes due 2006 (the 9

1/4% Seven Year Notes) and $1.625 billion principal amount of 9 3/8% Senior Notes due 2009 (the 9 3/8%Ten Year

Notes). Interest accrues at annual rates of 9 1/4% and 9 3/8% on the 9 1/4% Seven Year and 9 3/8% Ten Year

Notes, respectively. Interest on the 9 1/4% Seven and 9 3/8% Ten Year Notes is payable semi-annually in cash in

arrears on February 1 and August 1 of each year, commencing August 1, 1999.

Concurrently with the closing of the 9 1/4% Seven Year Notes and 9 3/8% Ten Year Notes offering,

EchoStar used approximately $1.658 billion of net proceeds received from the sale of the 9 1/4% Seven and 9 3/8%

Ten Year Notes to complete tender offers for its outstanding 1994 Notes, 1996 Notes and 1997 Notes. In February

1999, EchoStar used approximately $268 million of net proceeds received from the sale of the 9 1/4% Seven and 9

3/8% Ten Year Notes to complete the tender offers related to the 12 1/8% Senior Exchange Notes due 2004, issued

on January 4, 1999, in exchange for all issued and outstanding 12 1/8% Series B Senior Redeemable Exchangeable

Preferred Stock.

With the exception of certain de minimis domestic and foreign subsidiaries, the 9 1/4% Seven and 9 3/8%

Ten Year Notes are fully, unconditionally and jointly and severally guaranteed by all subsidiaries of EDBS. The

9 1/4% Seven and 9 3/8% Ten Year Notes are general senior unsecured obligations which:

• rank pari passu in right of payment to each other and to all existing and future senior unsecured

obligations;

• rank senior to all existing and future junior obligations; and

• are effectively junior to secured obligations to the extent of the collateral securing such obligations,

including any borrowings under future secured credit facilities.

Except under certain circumstances requiring prepayment premiums, and in other limited circumstances,

the 9 1/4% Seven and 9 3/8% Ten Year Notes are not redeemable at EDBS’s option prior to February 1, 2003 and

February 1, 2004, respectively. Thereafter, the 9 1/4% Seven Year Notes will be subject to redemption, at the

option of EDBS, in whole or in part, at redemption prices decreasing from 104.625% during the year commencing

February 1, 2003 to 100% on or after February 1, 2005, together with accrued and unpaid interest thereon to the

redemption date. The 9 3/8% Ten Year Notes will be subject to redemption, at the option of EDBS, in whole or in

part, at redemption prices decreasing from 104.688% during the year commencing February 1, 2004 to 100% on or

after February 1, 2008, together with accrued and unpaid interest thereon to the redemption date.