Dish Network 2000 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–21

5. Income Taxes

As of December 31, 2000, EchoStar had net operating loss carryforwards (“NOLs”) for Federal income tax

purposes of approximately $2.050 billion. The NOLs will begin to expire in the year 2012. The use of the NOLs is

subject to statutory and regulatory limitations regarding changes in ownership. Financial Accounting Standard

No. 109, “Accounting for Income Taxes,” (“FAS No. 109”) requires that the potential future tax benefit of NOLs be

recorded as an asset. FAS No. 109 also requires that deferred tax assets and liabilities be recorded for the estimated

future tax effects of temporary differences between the tax basis and book value of assets and liabilities. Deferred

tax assets are offset by a valuation allowance to the extent deemed necessary.

In 2000, EchoStar increased its valuation allowance sufficient to fully offset net deferred tax assets arising

during the year. Realization of net deferred tax assets is not assured and is principally dependent on generating

future taxable income prior to expiration of the NOLs. Management believes existing net deferred tax assets in

excess of the valuation allowance will, more likely than not, be realized. EchoStar continuously reviews the

adequacy of its valuation allowance. Future decreases to the valuation allowance will be made only as changed

circumstances indicate that it is more likely than not that the additional benefits will be realized. Any future

adjustments to the valuation allowance will be recognized as a separate component of EchoStar’s provision for

income taxes.

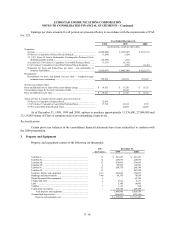

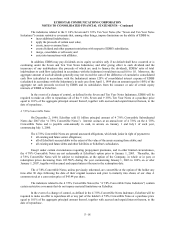

The actual tax (provision) benefit for 1998, 1999 and 2000 are reconciled to the amounts computed by

applying the statutory Federal tax rate to income before taxes as follows:

Year Ended December 31,

1998 1999 2000

Statutory rate .................................................................. 35.0% 35.0% 35.0%

State income taxes, net of Federal benefit ......................... 1.6 2.3 2.9

Employee stock option exercise and sale .......................... – – 3.3

Non-deductible interest expense....................................... (1.4) (0.3) –

Other ............................................................................. 0.5 1.3 1.6

Increase in valuation allowance........................................ (35.7) (38.3) (42.8)

Total benefit from income taxes................................... –% –% –%

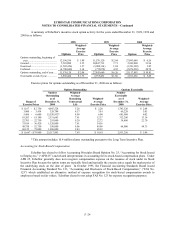

The components of the (provision for) benefit from income taxes are as follows (in thousands):

Year Ended December 31,

1998 1999 2000

Current (provision) benefit:

Federal .................................................................... $ 15 $ – $ –

State... ..................................................................... 18 (45) (80)

Foreign.................................................................... (77) (108) (475)

(44) (153) (555)

Deferred (provision) benefit:

Federal .................................................................... 86,604 286,195 237,744

State........................................................................ 6,463 27,748 27,623

Increase in valuation allowance ................................. (93,067) (313,943) (265,367)

– – –

Total (provision) benefit........................................ $ (44) $ (153) $ (555)