Dish Network 2000 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–24

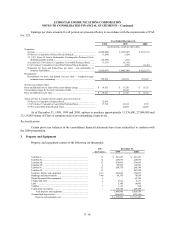

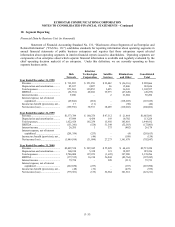

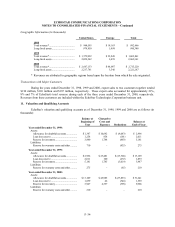

A summary of EchoStar’s incentive stock option activity for the years ended December 31, 1998, 1999 and

2000 is as follows:

1998 1999 2000

Options

Weighted-

Average

Exercise

Price Options

Weighted-

Average

Exercise

Price Options

Weighted-

Average

Exercise

Price

Options outstanding, beginning of

year.......................................... 12,196,536 $ 1.88 11,576,120 $ 2.04 27,843,640 $ 6.26

Granted ........................................ 5,585,080 2.35 20,847,712 7.71 2,942,000 51.56

Exercised...................................... (1,505,456) 1.57 (3,808,114) 1.84 (3,591,209) 3.05

Forfeited....................................... (4,700,040) 2.14 (772,078) 4.92 (2,076,538) 20.78

Options outstanding, end of year .... 11,576,120 $ 2.04 27,843,640 $ 6.26 25,117,893 $ 10.81

Exercisable at end of year .............. 3,858,424 $ 1.73 2,755,432 $ 1.86 2,911,256 $ 5.49

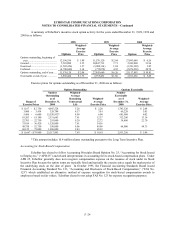

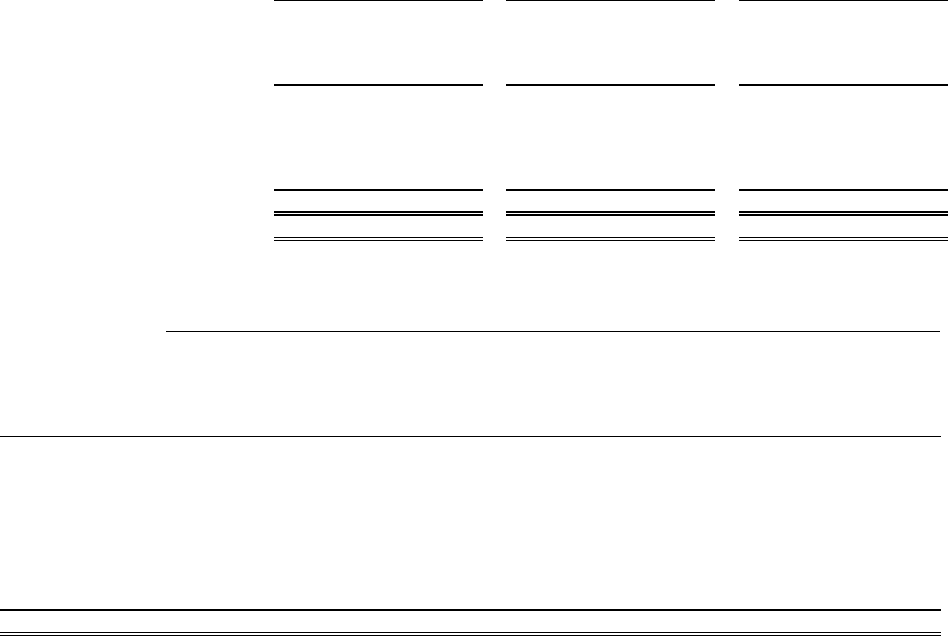

Exercise prices for options outstanding as of December 31, 2000 are as follows:

Options Outstanding Options Exercisable

Range of

Exercise Prices

Number

Outstanding

as of

December 31,

2000

Weighted-

Average

Remaining

Contractual

Life

Weighted-

Average

Exercise Price

Number

Exercisable

as of

December 31,

2000

Weighted-

Average

Exercise Price

$ 1.167 - $ 2.750 4,047,528 5.28 $ 2.20 1,745,520 $ 2.08

3.000 - 3.434 328,788 6.17 3.01 69,228 3.05

5.486 - 6.600 15,350,932* 8.09 6.00 685,908 6.02

10.203 - 19.180 2,331,645 7.61 12.37 312,200 13.16

22.703 - 22.750 293,000 9.20 22.72 34,400 22.70

33.109 - 36.420 1,320,000 7.61 34.36 – –

48.750 - 52.750 350,000 9.06 49.09 64,000 48.75

60.125 - 79.000 1,096,000 9.43 65.22 – –

$ 1.1667 - $ 79.000 25,117,893 7.63 $ 10.81 2,911,256 $ 5.49

* This amount includes 10.4 million shares outstanding pursuant to the Long Term Incentive Plan.

Accounting for Stock-Based Compensation

EchoStar has elected to follow Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued

to Employees,” (“APB 25”) and related interpretations in accounting for its stock-based compensation plans. Under

APB 25, EchoStar generally does not recognize compensation expense on the issuance of stock under its Stock

Incentive Plan because the option terms are typically fixed and typically the exercise price equals the market price of

the underlying stock on the date of grant. In October 1995, the Financial Accounting Standards Board issued

Financial Accounting Standard No. 123, “Accounting and Disclosure of Stock-Based Compensation,” (“FAS No.

123”) which established an alternative method of expense recognition for stock-based compensation awards to

employees based on fair values. EchoStar elected to not adopt FAS No. 123 for expense recognition purposes.