Dish Network 2000 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

In addition to the $1.464 billion, we have made strategic equity investments in Wildblue Communications,

StarBand Communications, VisionStar, Inc. and Replay TV totaling approximately $110 million. The securities of

these companies are not publicly traded. StarBand recently announced that it was canceling its planned initial public

stock offering. Our ability to create realizable value for our strategic investments in companies that are not public is

dependent on the success of their business plans. Among other things, there is relatively greater risk that those

companies may not be able to raise sufficient capital to fully finance their business plans. Since private markets are

not as liquid as public markets, there is also increased risk that we will not be able to sell these investments, or that

when we desire to sell them that we will be able to obtain full value for them.

We currently have accumulated net unrealized losses on certain of our investments as disclosed on our

accompanying balance sheets. There can be no assurance that the accumulated net unrealized losses will not

increase or that some or all of these losses will not have to be recorded as charges to earnings in future periods. We

have not used derivative financial instruments for speculative purposes. We have not hedged or otherwise protected

against the risks associated with any of our investing or financing activities.

As of December 31, 2000, we estimated the fair value of our fixed-rate debt and mortgages and other notes

payable to be approximately $3.7 billion using quoted market prices where available, or discounted cash flow analyses.

The fair value of our fixed rate debt and mortgages is affected by fluctuations in interest rates. A hypothetical 10%

decrease in assumed interest rates would increase the fair value of our debt by approximately $196 million. To the

extent interest rates increase, our costs of financing would increase at such time as we are required to refinance our

debt.

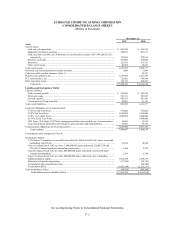

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Our Consolidated Financial Statements are included in this report beginning on page F-1.

Item 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.