Dish Network 2000 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2000 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

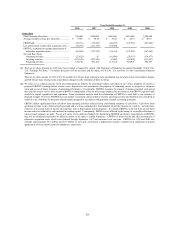

Earnings Before Interest, Taxes, Depreciation and Amortization. EBITDA represents earnings before

interest, taxes, depreciation, amortization, and non-cash, stock-based compensation. EBITDA was negative $173

million during the year ended December 31, 1999 compared to negative $20 million during the same period in 1998.

EBITDA, as adjusted to exclude amortization of subscriber acquisition costs, was negative $173 million for the year

ended December 31, 1999 compared to negative $39 million for the same period in 1998. This decline in EBITDA

principally resulted from an increase in DISH Network operating and marketing expenses. Our calculation of

EBITDA for the year ended December 31, 1999 does not include approximately $61 million of non-cash

compensation expense resulting from post-grant appreciation of stock options granted to employees.

It is important to note that EBITDA and pre-marketing cash flow do not represent cash provided or used by

operating activities. EBITDA and pre-marketing cash flow should not be considered in isolation or as a substitute

for measures of performance prepared in accordance with generally accepted accounting principles.

Depreciation and Amortization. Depreciation and amortization expenses aggregated $113 million during

1999, a $10 million increase compared to the same period in 1998, during which subscriber acquisition costs were

amortized. Commencing October 1997, we instead expensed all of these costs at the time of sale. The increase in

depreciation and amortization expenses principally resulted from an increase in depreciation related to the

commencement of operation of EchoStar IV in August of 1998, the commencement of operation of EchoStar V in

November 1999 and other depreciable assets placed in service during 1999, partially offset by subscriber acquisition

costs becoming fully amortized during the third quarter of 1998.

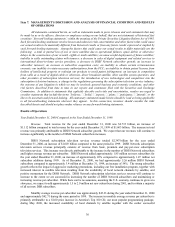

Other Income and Expense. Other expense, net totaled $177 million during 1999, an increase of

$39 million compared to the same period in 1998. This increase resulted from an increase in interest expense. In

January 1999, we refinanced our outstanding 12 1/2% Senior Secured Notes due 2002 issued in June 1997, our

12 7/8% Senior Secured Discount Notes due 2004 issued in 1994, and our 13 1/8% Senior Secured Discount Notes

due 2004 issued in 1996 at more favorable interest rates and terms. In connection with the refinancing, we

consummated an offering of 9 1/4% Senior Notes due 2006 and 9 3/8% Senior Notes due 2009, referred to herein as

the 9 1/4% Seven Year Notes and 9 3/8% Ten Year Notes. Although the 9 1/4% Seven Year Notes and 9 3/8% Ten

Year Notes have lower interest rates than the debt securities we repurchased, interest expense increased by

approximately $34 million because we raised additional debt to cover tender premiums and consent and other fees

related to the refinancing.

Extraordinary Charge for Early Retirement of Debt. In connection with the January 1999 refinancing, we

recognized an extraordinary loss of $269 million comprised of debt costs, discounts, tender costs, and premiums

paid over the accreted values of the debt retired.

LIQUIDITY AND CAPITAL RESOURCES

Cash Sources

Since inception, we have financed the development of our EchoStar DBS system and the related commercial

introduction of the DISH Network service primarily through the sale of equity and debt securities and cash from

operations. From May 1994 through December 31, 2000, we have raised total gross cash proceeds of approximately

$249 million from the sale of our equity securities and as of December 31, 2000, we had approximately $4.0 billion of

outstanding long-term debt (including current portion).

On September 25, 2000, our wholly-owned subsidiary, EchoStar Broadband Corporation, sold $1 billion

principal amount of 10 3/8% Senior Notes due 2007. The proceeds of these notes will be used primarily by our

subsidiaries for the construction and launch of additional satellites, strategic acquisitions and other general working

capital purposes.

As of December 31, 2000, our unrestricted cash, cash equivalents and marketable investment securities totaled

$1.464 billion compared to $1.254 billion as of December 31, 1999. For the years ended December 31, 2000, 1999 and

1998, we reported net cash flows from operating activities of negative $119 million, negative $59 million and negative

$17 million, respectively. The increase in net cash flow used in operating activities reflects, among other things, the