Dell 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

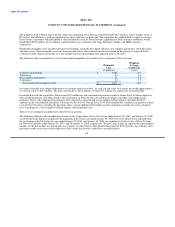

discounted cash flow analyses, an impairment charge would be recorded. Based on the results of the annual impairment tests, no

impairment of goodwill existed at July 30, 2010. Further, no triggering events have transpired since July 30, 2010, that would indicate a

potential impairment of goodwill as of January 28, 2011. Dell does not have any accumulated goodwill impairment charges as of

January 28, 2011. The goodwill adjustments are primarily the result of contingent purchase price considerations related to prior period

acquisitions and the effects of foreign currency fluctuations.

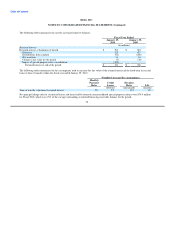

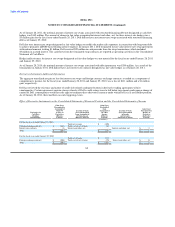

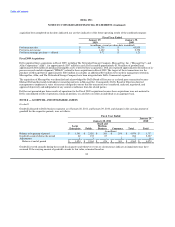

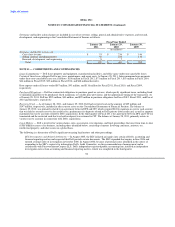

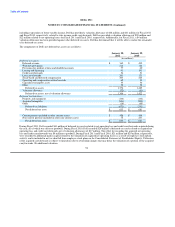

Intangible Assets

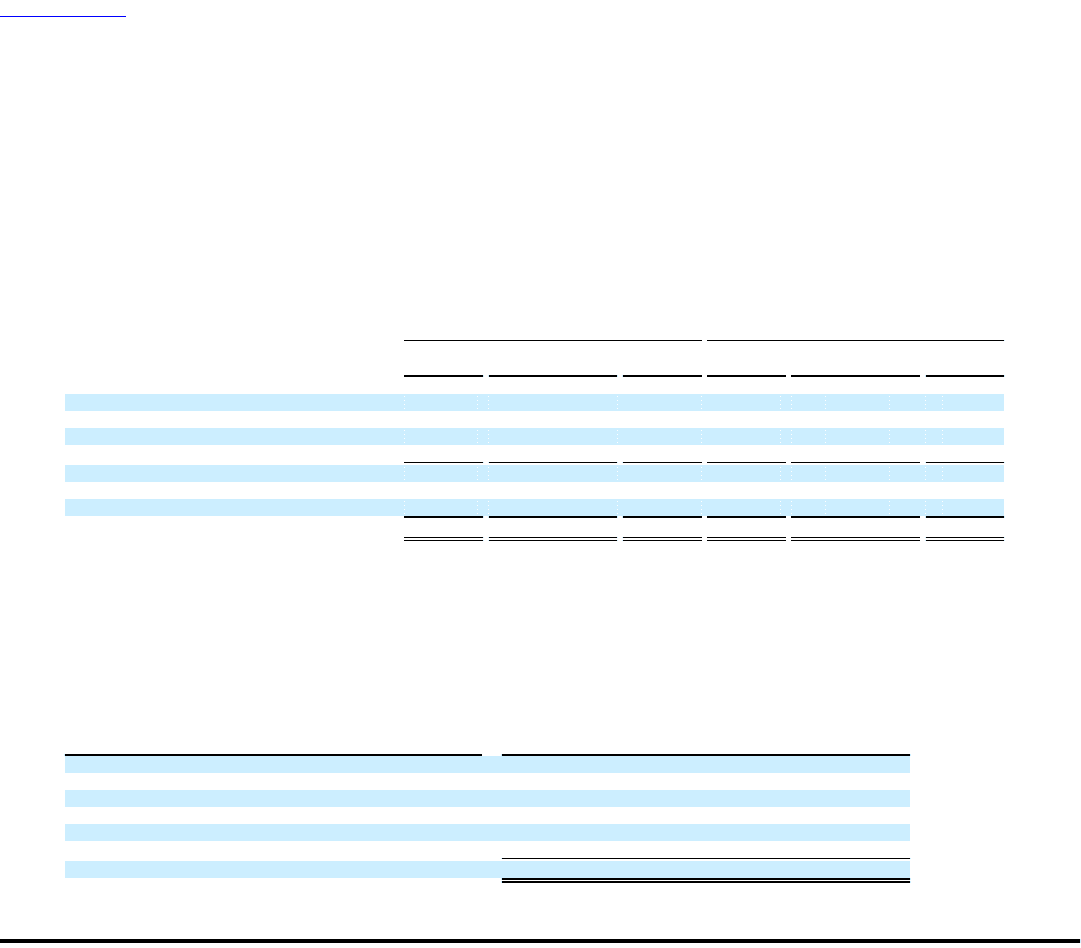

Dell's intangible assets associated with completed acquisitions at January 28, 2011 and January 29, 2010, are as follows:

January 28, 2011 January 29, 2010

Accumulated Accumulated

Gross Amortization Net Gross Amortization Net

(in millions)

Customer relationships $ 1,363 $ (309) $ 1,054 $ 1,324 $ (117) $ 1,207

Technology 647 (322) 325 568 (196) 372

Non-compete agreements 68 (26) 42 64 (8) 56

Tradenames 54 (31) 23 51 (17) 34

Amortizable intangible assets 2,132 (688) 1,444 2,007 (338) 1,669

In-process research and development 26 - 26 - - -

Indefinite lived intangible assets 25 - 25 25 - 25

Total intangible assets $ 2,183 $ (688) $ 1,495 $ 2,032 $ (338) $ 1,694

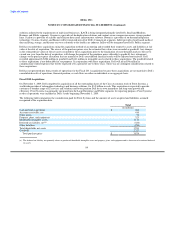

During Fiscal 2011, Dell recorded additions to intangible assets and in-process research and development of $126 million and

$26 million, respectively, which were primarily related to Dell's Fiscal 2011 business acquisitions. During Fiscal 2010, Dell recorded

additions to intangible assets of $1.2 billion, which were related to Dell's acquisition of Perot Systems.

Amortization expense related to finite-lived intangible assets was approximately $350 million and $205 million in Fiscal 2011 and Fiscal

2010, respectively. During the fiscal years ended January 28, 2011, and January 29, 2010, Dell did not record any impairment charges as

a result of its analysis of its intangible assets.

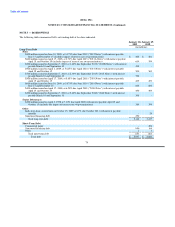

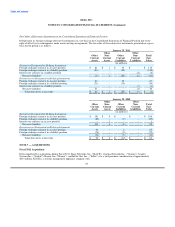

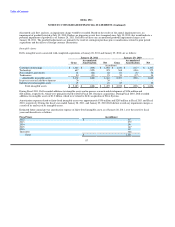

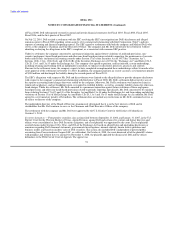

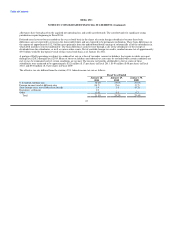

Estimated future annual pre-tax amortization expense of finite-lived intangible assets as of January 28, 2011, over the next five fiscal

years and thereafter is as follows:

Fiscal Years (in millions)

2012 $ 313

2013 279

2014 240

2015 147

2016 117

Thereafter 348

Total $ 1,444

87