Dell 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

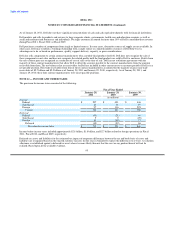

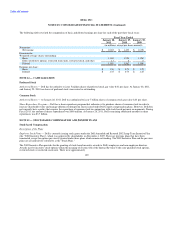

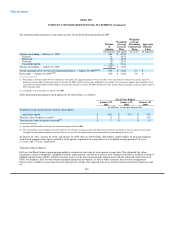

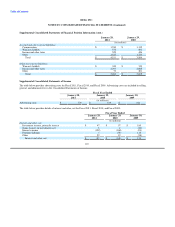

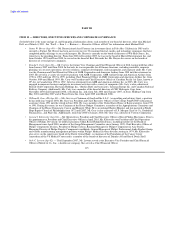

Stock-based Compensation Expense

Stock-based compensation expense was allocated as follows:

Fiscal Year Ended

January 28, January 29, January 30,

2011 2010 2009

(in millions)

Stock-based compensation expense:

Cost of net revenue $ 57 $ 47 $ 62

Operating expenses 275 265 356

Stock-based compensation expense before taxes 332 312 418

Income tax benefit (97) (91) (131)

Stock-based compensation expense, net of income taxes $ 235 $ 221 $ 287

Stock-based compensation in the table above includes $104 million of expense for accelerated options and a reduction of $1 million for

the release of the accrual for expired stock options in Fiscal 2009, as previously discussed.

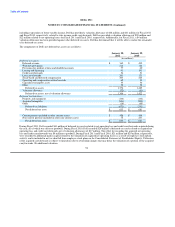

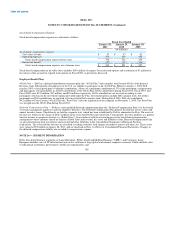

Employee Benefit Plans

401(k) Plan — Dell has a defined contribution retirement plan (the "401(k) Plan") that complies with Section 401(k) of the Internal

Revenue Code. Substantially all employees in the U.S. are eligible to participate in the 401(k) Plan. Effective January 1, 2008, Dell

matches 100% of each participant's voluntary contributions, subject to a maximum contribution of 5% of the participant's compensation,

and participants vest immediately in all Dell contributions to the 401(k) Plan. Dell's contributions during Fiscal 2011, Fiscal 2010, and

Fiscal 2009 were $132 million, $91 million, and $93 million, respectively. Dell's contributions are invested according to each

participant's elections in the investment options provided under the Plan. Investment options include Dell common stock, but neither

participant nor Dell contributions are required to be invested in Dell common stock. During Fiscal 2010, Dell also contributed

$4.2 million to Perot Systems' 401(k) Plan (the "Perot Plan") after the acquisition of the company on November 3, 2009. The Perot Plan

was merged into the 401(k) Plan during Fiscal 2011.

Deferred Compensation Plan — Dell has a non-qualified deferred compensation plan (the "Deferred Compensation Plan") for the benefit

of certain management employees and non-employee directors. The Deferred Compensation Plan permits the deferral of base salary and

annual incentive bonus. The deferrals are held in a separate trust, which has been established by Dell to administer the Plan. The assets of

the trust are subject to the claims of Dell's creditors in the event that Dell becomes insolvent. Consequently, the trust qualifies as a grantor

trust for income tax purposes (known as a "Rabbi Trust"). In accordance with the accounting provisions for deferred compensation

arrangements where amounts earned are held in a Rabbi Trust and invested, the assets and liabilities of the Deferred Compensation Plan

are presented in long-term investments and accrued and other liabilities in the Consolidated Statements of Financial Position,

respectively. The assets held by the trust are classified as trading securities with changes recorded to interest and other, net. These assets

were valued at $99 million at January 28, 2011, and are disclosed in Note 3 of Notes to Consolidated Financial Statements. Changes in

the deferred compensation liability are recorded to compensation expense.

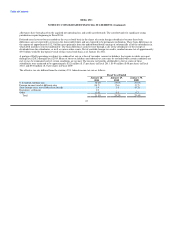

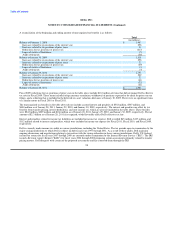

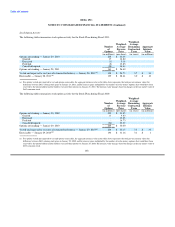

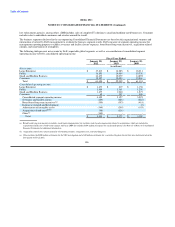

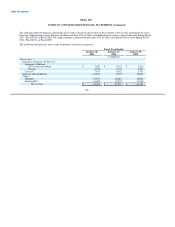

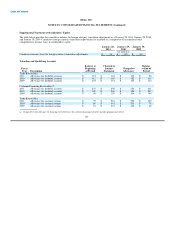

NOTE 16 — SEGMENT INFORMATION

Dell's four global business segments are Large Enterprise, Public, Small and Medium Business ("SMB"), and Consumer. Large

Enterprise includes sales of IT infrastructure and service solutions to large global and national corporate customers. Public includes sales

to educational institutions, governments, health care organizations, and

105