Dell 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

acquisition been completed on the dates indicated, nor are they indicative of the future operating results of the combined company.

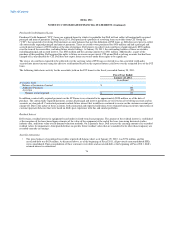

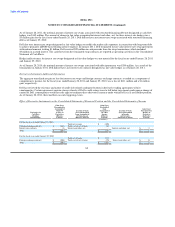

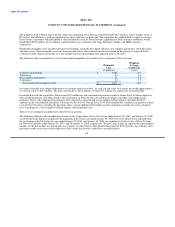

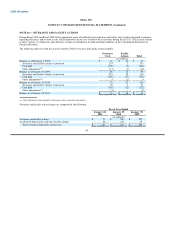

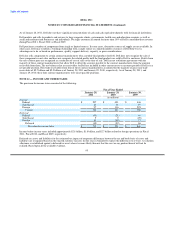

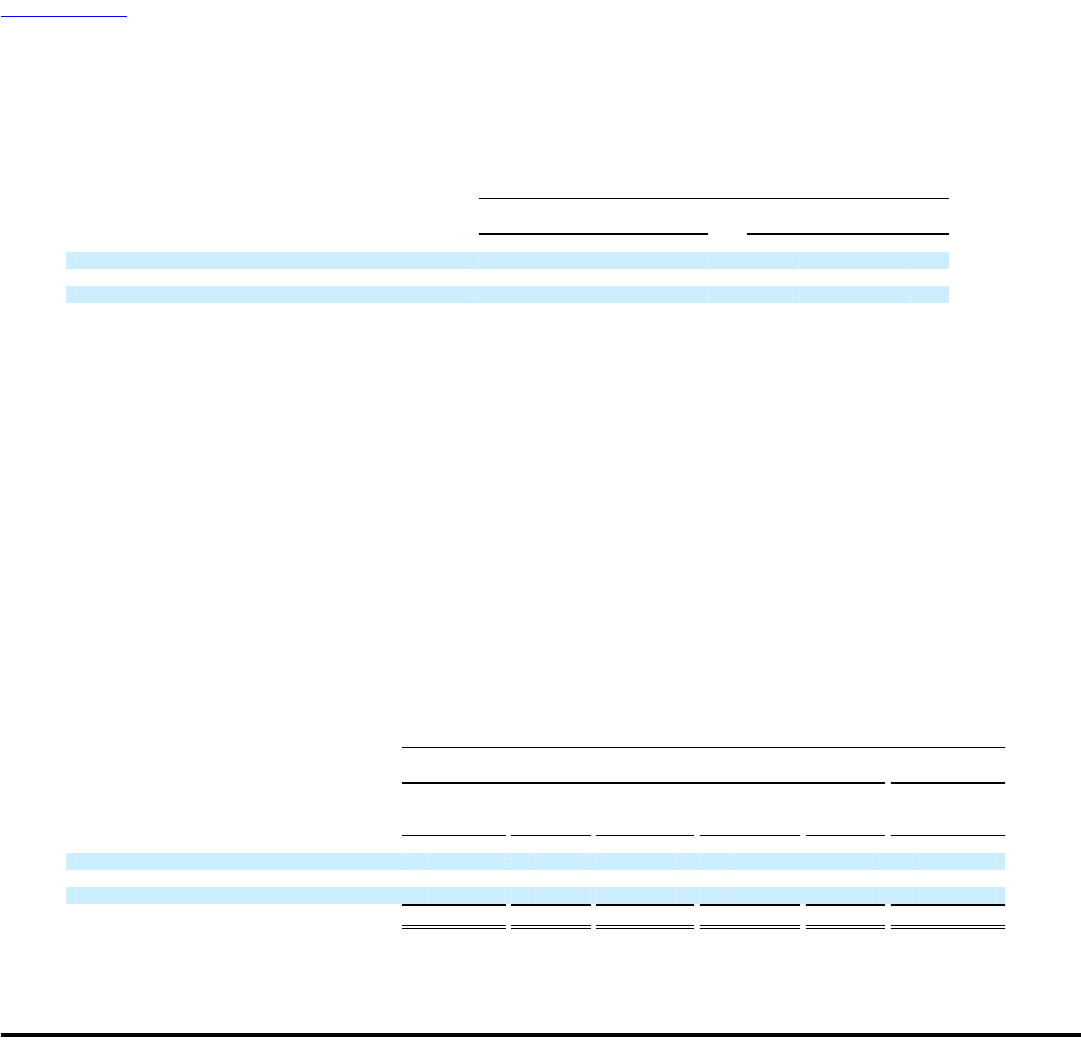

Fiscal Year Ended

January 29, January 30,

2010 2009

(in millions, except per share data, unaudited)

Pro forma net sales $ 54,739 $ 63,835

Pro forma net income $ 1,422 $ 2,398

Pro forma earnings per share — diluted $ 0.72 $ 1.21

Fiscal 2009 Acquisitions

Dell completed three acquisitions in Fiscal 2009, including The Networked Storage Company, MessageOne, Inc. ("MessageOne"), and

Allin Corporation ("Allin"), for approximately $197 million in cash. Dell recorded approximately $136 million of goodwill and

approximately $64 million of purchased intangible assets related to these acquisitions. Dell also expensed approximately $2 million of in-

process research and development ("IPR&D") related to these acquisitions in Fiscal 2009. The largest of these transactions was the

purchase of MessageOne for approximately $164 million in cash plus an additional $10 million to be used for management retention.

MessageOne, Allin, and The Networked Storage Company have been integrated into Dell's Commercial segments.

The acquisition of MessageOne was identified and acknowledged by Dell's Board of Directors as a related party transaction because

Michael Dell and his family held indirect ownership interests in MessageOne. Consequently, Dell's Board of Directors directed

management to implement a series of measures designed to ensure that the transaction was considered, analyzed, negotiated, and

approved objectively and independent of any control or influence from the related parties.

Dell has not presented pro forma results of operations for the Fiscal 2009 acquisitions because these acquisitions were not material to

Dell's consolidated results of operations, financial position, or cash flows on either an individual or an aggregate basis.

NOTE 8 — GOODWILL AND INTANGIBLE ASSETS

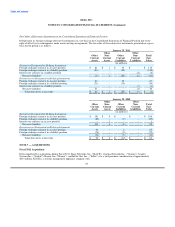

Goodwill

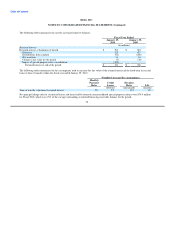

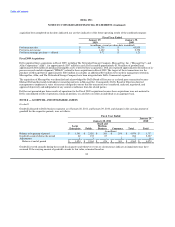

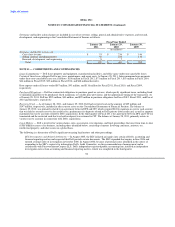

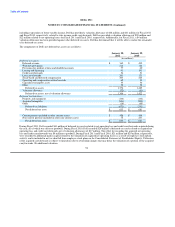

Goodwill allocated to Dell's business segments as of January 28, 2011, and January 29, 2010, and changes in the carrying amount of

goodwill for the respective periods, were as follows:

Fiscal Year Ended

January 29,

January 28, 2011 2010

Small and

Large Medium

Enterprise Public Business Consumer Total Total

(in millions)

Balance at beginning of period $ 1,361 $ 2,026 $ 389 $ 298 $ 4,074 $ 1,737

Goodwill acquired during the period 62 135 87 - 284 2,327

Adjustments 1 3 - 3 7 10

Balance at end of period $ 1,424 $ 2,164 $ 476 $ 301 $ 4,365 $ 4,074

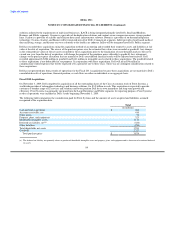

Goodwill is tested annually during the second fiscal quarter and whenever events or circumstances indicate an impairment may have

occurred. If the carrying amount of goodwill exceeds its fair value, estimated based on

86