Dell 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

instruments from the calculation of diluted earnings per share if the effect of including such instruments is anti-dilutive. See Note 13 of

Notes to Consolidated Financial Statements for further information on earnings per share.

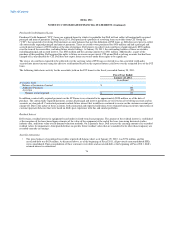

Stock-Based Compensation — Dell measures stock-based compensation expense for all share-based awards granted based on the

estimated fair value of those awards at grant-date. The cost of restricted stock units and performance-based restricted stock units are

determined using the fair market value of Dell's common stock on the date of grant. Dell also has a limited number of performance-based

units that include a market-based condition. The fair value of the market-condition and performance-condition portion of the award is

estimated using the Monte Carlo simulation valuation model. The expense recognized for these market-condition and performance-

condition based awards were not material for Fiscal 2011. The fair values of stock option awards are estimated using a Black-Scholes

valuation model. The compensation costs of stock options, restricted stock units, and awards with a cliff vesting feature are recognized

net of any estimated forfeitures on a straight-line basis over the employee requisite service period. Compensation cost for performance

based awards is recognized on a graded accelerated basis net of estimated forfeitures over the requisite service period. Forfeiture rates are

estimated at grant date based on historical experience and adjusted in subsequent periods for differences in actual forfeitures from those

estimates. See Note 15 of Notes to Consolidated Financial Statements included for further discussion of stock-based compensation.

Recently Issued and Adopted Accounting Pronouncements

Revenue Arrangements with Multiple Elements and Revenue Arrangements with Software Elements — In September 2009, the Emerging

Issues Task Force of the FASB reached a consensus on two issues which affects the timing of revenue recognition. The first consensus

changes the level of evidence of standalone selling price required to separate deliverables in a multiple deliverable revenue arrangement

by allowing a company to make its best estimate of the selling price of deliverables when more objective evidence of selling price is not

available and eliminates the residual method. The consensus applies to multiple deliverable revenue arrangements that are not accounted

for under other accounting pronouncements and retains the use of VSOE if available and third-party evidence of selling price when

VSOE is unavailable. The second consensus excludes sales of tangible products that contain essential software elements, that is, software

enabled devices, from the scope of revenue recognition requirements for software arrangements. Dell elected to early adopt this

accounting guidance at the beginning of the first quarter of Fiscal 2011 on a prospective basis for applicable transactions originating or

materially modified after January 29, 2010. The adoption of this guidance did not have a material impact to Dell's consolidated financial

statements.

Variable Interest Entities and Transfers of Financial Assets and Extinguishments of Liabilities — In June 2009, the FASB issued a new

pronouncement on transfers of financial assets and extinguishments of liabilities which removes the concept of a qualifying special

purpose entity and removes the exception from applying variable interest entity accounting to qualifying special purpose entities. See

"Asset Securitization" above for more information.

Credit Quality of Financing Receivables and the Allowance for Credit Losses — In July 2010, FASB issued a new pronouncement that

requires enhanced disclosures regarding the nature of credit risk inherent in an entity's portfolio of financing receivables, how that risk is

analyzed, and the changes and reasons for those changes in the allowance for credit losses. The new disclosures require information for

both the financing receivables and the related allowance for credit losses at more disaggregated levels. Disclosures related to information

as of the end of a reporting period became effective for Dell in Fiscal 2011. Specific disclosures regarding activities that occur during a

reporting period will be required for Dell beginning in the first quarter of Fiscal 2012. As these changes relate only to disclosures, they

will not have an impact on Dell's consolidated financial results.

68