Dell 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

benefit from decreasing component costs, particularly for memory and displays. We expect this favorable component cost

environment will moderate in the first half of Fiscal 2012.

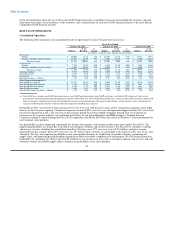

• Services, including software related — During Fiscal 2011, our services gross margin increased in absolute dollars compared to the

prior fiscal year, although our gross margin percentage decreased. The decrease in gross margin percentage for services, including

software related was primarily due to a higher mix of outsourcing and project-related services. Our gross margin rate for services,

including software related, is driven by our transactional services, which consist primarily of our extended warranty sales, offset by

lower margin categories such as outsourcing and project-related services. Our extended warranty services are more profitable because

we sell extended warranty offerings directly to customers rather than through a distribution channel.

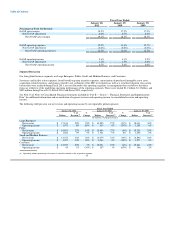

Total gross margin for Fiscal 2011 increased 23% to $11.4 billion on a GAAP basis and 22% to $11.7 billion on a non-GAAP basis from

Fiscal 2010. Gross margin on a GAAP basis for Fiscal 2011 and Fiscal 2010 includes the effects of amortization of intangible assets,

severance and facility action costs, and acquisition-related charges. As set forth in the reconciliation under "Non-GAAP Financial

Measures" below, these items are excluded from the calculation of non-GAAP gross margin for Fiscal 2011 and Fiscal 2010.

Amortization of intangible assets included in gross margin increased 84% to $278 million for Fiscal 2011. The increase in amortization of

intangibles for Fiscal 2011 was primarily due to an increase in intangible assets of $1.2 billion in Fiscal 2010 related to our acquisition of

Perot Systems. Severance and facility action costs included in gross margin decreased 78% to $53 million during Fiscal 2011. The

decrease in severance and facility action costs was due to a decrease in cost reduction activities from Fiscal 2010. While we believe that

we have completed a significant portion of our manufacturing transformation, we expect to implement additional cost reduction measures

depending on a number of factors, including end-user demand for our products and services and the continued simplification of our sales

organizations and supply and logistics chain. Additional cost reduction measures may include selected headcount reductions, as well as

other cost reduction programs.

Fiscal 2010 compared to Fiscal 2009

• Products — Product gross margin decreased in absolute dollars and in gross margin percentage during Fiscal 2010. The decline in

gross margin dollars was attributable to softer demand, change in sales mix, and lower average selling prices. Additionally, during

Fiscal 2010, gross margins were negatively impacted by component cost pressures.

• Services, including software related — During Fiscal 2010, our services gross margin decreased in absolute dollars compared to the

prior fiscal year with a corresponding decrease in gross margin percentage. Our solution services offerings faced competitive pricing

pressures, resulting in lower gross margin percentages.

Total gross margin for Fiscal 2010 decreased 15% to $9.3 billion on a GAAP basis and 14% to $9.6 billion on a non-GAAP basis from

Fiscal 2009. Gross margin on a GAAP basis for Fiscal 2010 includes the effects of severance and facility action costs, amortization of

intangible assets, and acquisition-related charges. Gross margin on a GAAP basis for Fiscal 2009 includes the effects of severance and

facility action costs, amortization of intangible assets, and stock option accelerated vesting charges. As set forth in the reconciliation

under "Non-GAAP Financial Measures" below, these items are excluded from the calculation of non-GAAP gross margin for Fiscal 2010

and Fiscal 2009. Amortization of intangible assets included in gross margin increased 156% to $151 million for Fiscal 2010. The increase

in amortization of intangibles for Fiscal 2010 was primarily due to an increase in intangible assets from our acquisition of Perot Systems

in Fiscal 2010 discussed above. Severance and facility action costs included in gross margin increased 62% to $236 million during Fiscal

2010 due to our migration to contract manufacturers and closures of certain manufacturing facilities. For Fiscal 2009, we incurred

$104 million in certain stock-based compensation charges related to accelerated options that had an exercise price greater than the current

market stock price. Included in gross margin on a GAAP basis is $16 million from these stock option accelerated vesting charges, which

are excluded from the calculation of our non-GAAP gross margin. We did not have any accelerated stock option expenses in Fiscal 2010.

26