Dell 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

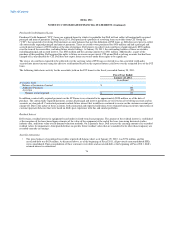

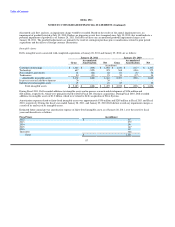

As of January 28, 2011, the notional amount of interest rate swaps associated with structured financing debt not designated as cash flow

hedges was $145 million. The amount of change in fair value recognized in interest and other, net, for these interest rate hedges was a

$3 million gain for the fiscal year ended January 28, 2011. Dell did not have any interest rate swaps associated with structured financing

debt as of January 29, 2010.

Dell also uses interest rate swaps designated as fair value hedges to modify the market risk exposures in connection with long-term debt

to achieve primarily LIBOR-based floating interest expense. In January 2011, Dell terminated its fair value interest rate swap agreements

with notional amounts totaling $1 billion. Dell received $22 million in cash proceeds from the swap terminations, which included

$3 million in accrued interest. The cash flows from the terminated swap contracts are reported as operating activities in the Consolidated

Statement of Cash Flows.

Hedge ineffectiveness for interest rate swaps designated as fair value hedges was not material for the fiscal years ended January 28, 2011

and January 29, 2010.

As of January 29, 2010, the notional amount of interest rate swaps associated with debt instruments was $200 million. As a result of the

terminations in January 2011, Dell did not have any interest rate contracts designated as fair value hedges as of January 28, 2011.

Derivative Instruments Additional Information

The aggregate unrealized net gain or loss for interest rate swaps and foreign currency exchange contracts, recorded as a component of

comprehensive income, for the fiscal years ended January 28, 2011 and January 29, 2010, was a loss of $111 million and a $1 million

gain, respectively.

Dell has reviewed the existence and nature of credit-risk-related contingent features in derivative trading agreements with its

counterparties. Certain agreements contain clauses whereby if Dell's credit ratings were to fall below investment grade upon a change of

control of Dell, counterparties would have the right to terminate those derivative contracts under which Dell is in a net liability position.

As of January 28, 2011, there had been no such triggering events.

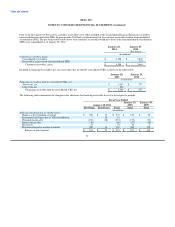

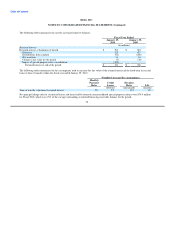

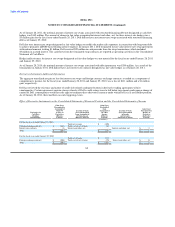

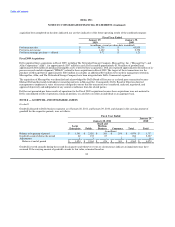

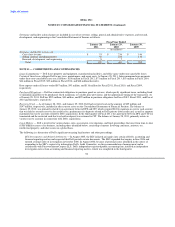

Effect of Derivative Instruments on the Consolidated Statements of Financial Position and the Consolidated Statements of Income

Gain (Loss) Gain (Loss)

Recognized in Reclassified

Accumulated from Gain (Loss)

OCI, Net Location of Gain Accumulated Location of Gain Recognized in

Derivatives in of Tax, on (Loss) Reclassified OCI into (Loss) Recognized Income on

Cash Flow Derivatives from Accumulated Income in Income Derivative

Hedging (Effective OCI into Incom (Effective on Derivative (Ineffective

Relationships Portion) (Effective Portion) Portion) (Ineffective Portion) Portion)

(in millions)

For the fiscal year ended January 28, 2011

Total net revenue $ (105)

Foreign exchange contracts $ (265) Total cost of net revenue (49)

Interest rate contracts (1) Interest and other, net - Interest and other, net $ 2

Total $ (266) $ (154) $ 2

For the fiscal year ended January 29, 2010

Total net revenue $ (157)

Foreign exchange contracts $ (506) Total cost of net revenue (25) Interest and other, net $ (1)

Total $ (506) $ (182) $ (1)

82