Dell 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

stockholders' equity and reclassifies the gain or loss into earnings in the period during which the hedged transaction is recognized in

earnings.

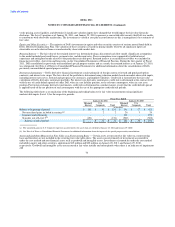

For derivatives that are designated as fair value hedges, hedge ineffectiveness is measured by calculating the periodic change in the fair

value of the hedge contract and the periodic change in the fair value of the hedged item. To the extent that these fair value changes do not

fully offset each other, the difference is recorded as ineffectiveness in earnings as a component of interest and other, net.

For derivatives that are not designated as hedges or do not qualify for hedge accounting treatment, Dell recognizes the change in the

instrument's fair value currently in earnings as a component of interest and other, net.

Cash flows from derivative instruments are presented in the same category on the Consolidated Statements of Cash Flows as the cash

flows from the underlying hedged items. See Note 6 of Notes to Consolidated Financial Statements for a full description of Dell's

derivative financial instrument activities.

Treasury Stock — Dell accounts for treasury stock under the cost method and includes treasury stock as a component of stockholders'

equity.

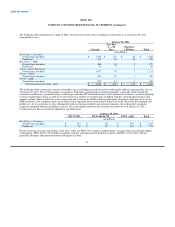

Revenue Recognition — Net revenues include sales of hardware, software and peripherals, and services. Dell recognizes revenue for

these products when it is realized or realizable and earned. Revenue is considered realized and earned when persuasive evidence of an

arrangement exists; delivery has occurred or services have been rendered; Dell's fee to its customer is fixed and determinable; and

collection of the resulting receivable is reasonably assured. Dell classifies revenue and cost of revenue related to standalone software sold

with Post Contract Support ("PCS") in the same line item as services on the Consolidated Statements of Income. Services revenue and

cost of services revenue captions on the Consolidated Statements of Income include Dell's services and software from Dell's software and

peripherals product category. This software revenue and related costs include software license fees and related PCS that is sold separately

from computer systems through Dell's software and peripherals product category.

Products

Revenue from the sale of products is recognized when title and risk of loss passes to the customer. Delivery is considered

complete when products have been shipped to Dell's customer, title and risk of loss has transferred to the customer, and

customer acceptance has been satisfied. Customer acceptance is satisfied through obtaining acceptance from the customer, the

acceptance provision lapses, or Dell has evidence that the acceptance provisions have been satisfied.

Dell records reductions to revenue for estimated customer sales returns, rebates, and certain other customer incentive

programs. These reductions to revenue are made based upon reasonable and reliable estimates that are determined by historical

experience, contractual terms, and current conditions. The primary factors affecting Dell's accrual for estimated customer

returns include estimated return rates as well as the number of units shipped that have a right of return that has not expired as

of the balance sheet date. If returns cannot be reliably estimated, revenue is not recognized until a reliable estimate can be

made or the return right lapses.

Dell sells its products directly to customers as well as through indirect channels, including retailers. Sales through Dell's

indirect channels are primarily made under agreements allowing for limited rights of return, price protection, rebates, and

marketing development funds. Dell has generally limited the return rights through contractual caps. Dell's policy for sales

through indirect channels is to defer the full amount of revenue relative to sales for which the rights of return apply unless

there is sufficient historical data to establish reasonable and reliable estimates of returns. To the extent price protection or

return rights are not limited and a reliable estimate cannot be made, all of the revenue and related costs are deferred until the

product has been sold to the end-user or the rights expire. Dell records estimated reductions to

64