Dell 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

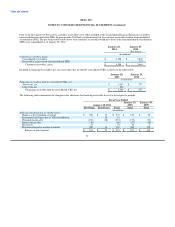

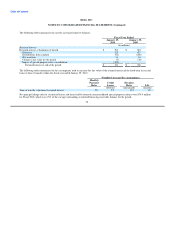

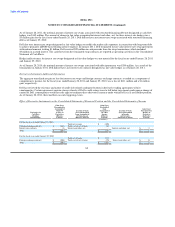

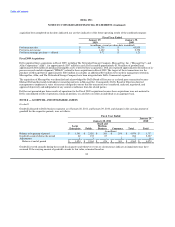

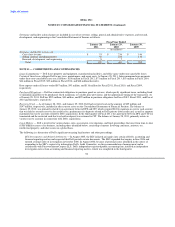

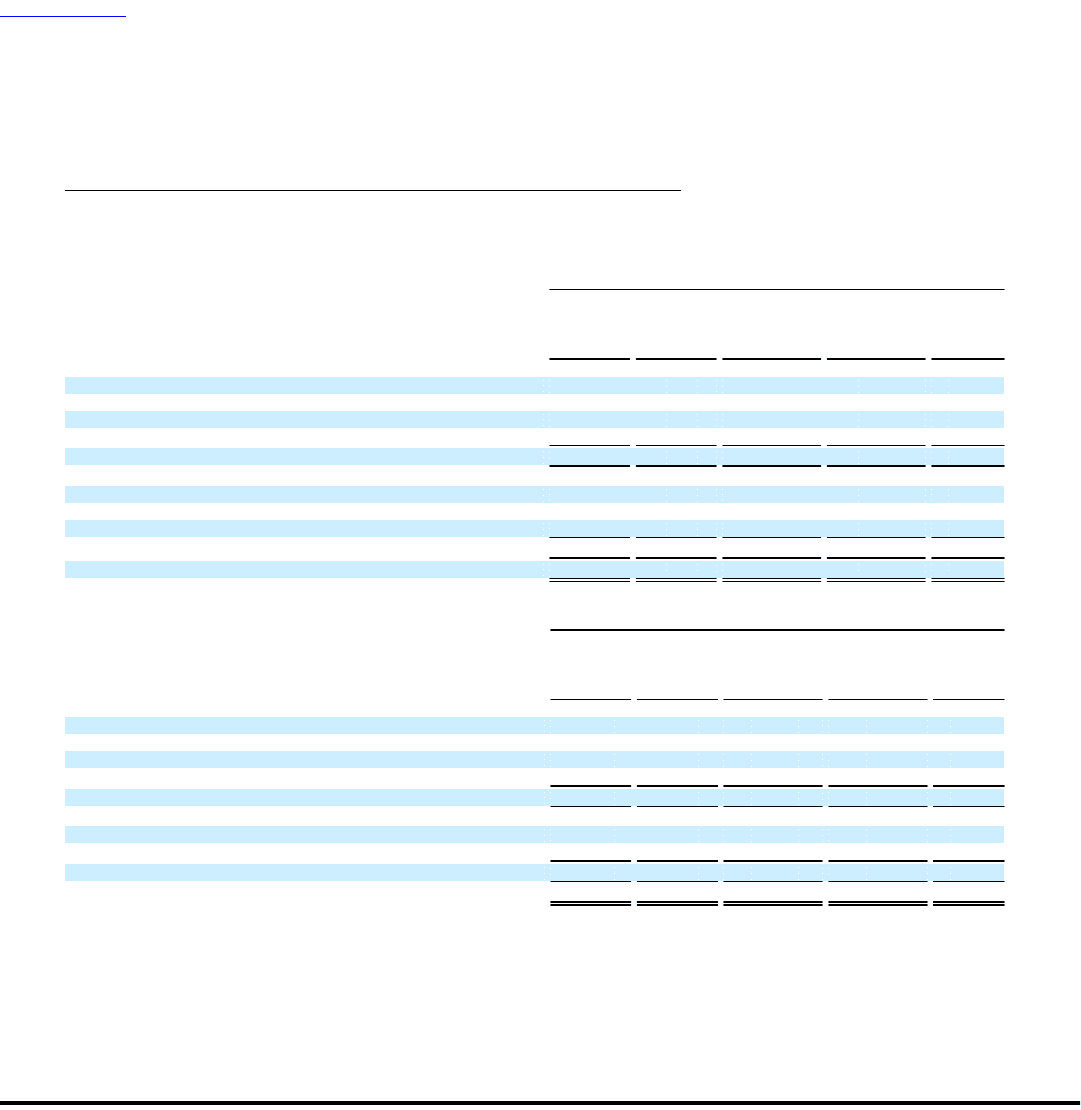

Fair Value of Derivative Instruments in the Consolidated Statements of Financial Position

Dell presents its foreign exchange derivative instruments on a net basis in the Consolidated Statements of Financial Position due to the

right of offset by its counterparties under master netting arrangements. The fair value of those derivative instruments presented on a gross

basis for the period is as follows:

January 28, 2011

Other Other

Other Non- Other Non- Total

Current Current Current Current Fair

Assets Assets Liabilities Liabilities Value

(in millions)

Derivatives Designated as Hedging Instruments

Foreign exchange contracts in an asset position $ 81 $ 1 $ 34 $ - $ 116

Foreign exchange contracts in a liability position (86) - (59) - (145)

Interest rate contracts in a liability position - - - (2) (2)

Net asset (liability) (5) 1 (25) (2) (31)

Derivatives not Designated as Hedging Instruments

Foreign exchange contracts in an asset position 52 15 - 67

Foreign exchange contracts in a liability position (21) - (15) - (36)

Interest rate contracts in a liability position - - - (1) (1)

Net asset (liability) 31 - - (1) 30

Total derivatives at fair value $ 26 $ 1 $ (25) $ (3) $ (1)

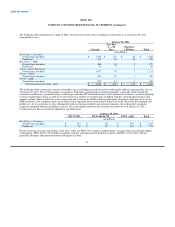

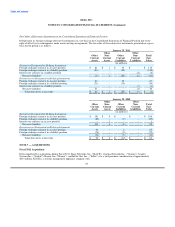

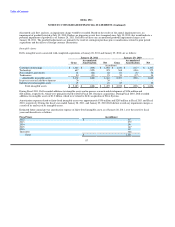

January 29, 2010

Other Other

Other Non- Other Non- Total

Current Current Current Current Fair

Assets Assets Liabilities Liabilities Value

(in millions)

Derivatives Designated as Hedging Instruments

Foreign exchange contracts in an asset position $ 181 $ 5 $ - $ - $ 186

Foreign exchange contracts in a liability position (80) - (9) - (89)

Interest rate contracts in an asset position - 1 - - 1

Net asset (liability) 101 6 (9) - 98

Derivatives not Designated as Hedging Instruments

Foreign exchange contracts in an asset position 63 - 2 - 65

Foreign exchange contracts in a liability position (74) - (5) - (79)

Net asset (liability) (11) - (3) - (14)

Total derivatives at fair value $ 90 $ 6 $ (12) $ - $ 84

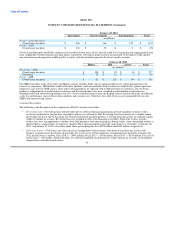

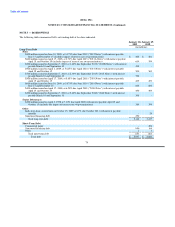

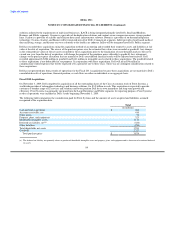

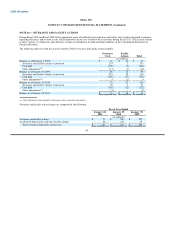

NOTE 7 — ACQUISITIONS

Fiscal 2011 Acquisitions

Dell completed five acquisitions during Fiscal 2011, Kace Networks, Inc. ("KACE"), Ocarina Networks Inc. ("Ocarina"), Scalent

Systems Inc. ("Scalent"), Boomi, Inc. ("Boomi"), and InSite One, Inc., ("InSite"), for a total purchase consideration of approximately

$413 million. KACE is a systems management appliance company with

83