Costco 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

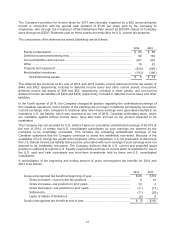

Included in the balance at the end of 2014, are $38 of tax positions for which the ultimate deductibility is

highly certain but for which there is uncertainty about the timing of such deductibility. Because of the

impact of deferred tax accounting, other than interest and penalties, the disallowance of these tax

positions would not affect the annual effective tax rate but would accelerate the payment of cash to the

taxing authority to an earlier period.

The total amount of such unrecognized tax benefits that, if recognized, would favorably affect the effective

income tax rate in future periods is $47 and $46 at the end of 2014 and 2013, respectively.

Accrued interest and penalties related to income tax matters are classified as a component of income tax

expense. Interest and penalties recognized by the Company were not material in 2014 and 2013. Accrued

interest and penalties were not material at the end of 2014 and 2013.

The Company is currently under audit by several taxing jurisdictions in the United States and in several

foreign countries. Some audits may conclude in the next 12 months and the unrecognized tax benefits we

have recorded in relation to the audits may differ from actual settlement amounts. It is not practical to

estimate the effect, if any, of any amount of such change during the next 12 months to previously

recorded uncertain tax positions in connection with the audits. The Company does not anticipate that

there will be a material increase or decrease in the total amount of unrecognized tax benefits in the next

12 months.

The Company files income tax returns in the United States, various state and local jurisdictions, in

Canada and in several other foreign jurisdictions. With few exceptions, the Company is no longer subject

to U.S. federal, state or local examination for years before fiscal 2007. The Company is currently subject

to examination in Canada for fiscal years 2010 to present and in California for fiscal years 2007 to

present. No other examinations are believed to be material.

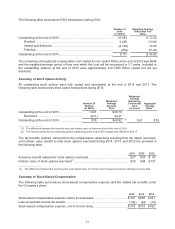

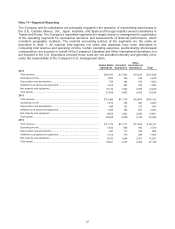

Note 9—Net Income per Common and Common Equivalent Share

The following table shows the amounts used in computing net income per share and the effect on net

income and the weighted average number of shares of potentially dilutive common shares outstanding

(shares in 000’s):

2014 2013 2012

Net income available to common stockholders after assumed

conversions of dilutive securities .............................................................. $ 2,058

$ 2,039 $ 1,710

Weighted average number of common shares used in basic net income

per common share .................................................................................... 438,693

435,741 433,620

RSUs and stock options ....................................................................................... 3,771

4,552 4,906

Conversion of convertible notes ......................................................................... 21

219 847

Weighted average number of common shares and dilutive potential of

common stock used in diluted net income

p

er share................................... 442,485

440,512 439,373