Costco 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 7—Stock-Based Compensation Plans

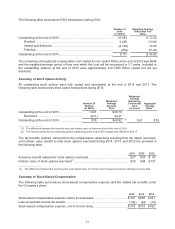

The Company grants stock-based compensation to employees and non-employee directors. Stock option

awards were granted under the Amended and Restated 2002 Stock Incentive Plan, amended as of

January 2006 (Second Restated 2002 Plan), and predecessor plans until, effective in the fourth quarter of

fiscal 2006, the Company began awarding RSUs under the Second Restated 2002 Plan in lieu of stock

options. Beginning in 2009, RSU grants to all executive officers have been performance-based. Through

a series of shareholder approvals, there have been amended and restated plans and new provisions

implemented by the Company. RSUs held by employees and non-employee directors are subject to

quarterly or daily vesting, respectively, upon certain terminations of employment or service. Employees

who attain certain years of service with the Company receive shares under accelerated vesting provisions

on the annual vesting date rather than upon qualified retirement. The Sixth Restated 2002 Stock Incentive

Plan (Sixth Plan), amended in the second quarter of fiscal 2012, is the Company’s only stock-based

compensation plan with shares available for grant at the end of 2014. Each share issued in respect of

stock awards is counted as 1.75 shares toward the limit of shares made available under the Sixth Plan.

The Sixth Plan authorized the issuance of 16,000,000 shares (9,143,000 RSUs) of common stock for

future grants. The Company issues new shares of common stock upon exercise of stock options and

upon vesting of RSUs. Shares for vested RSUs are generally delivered to participants annually, net of

shares equal to minimum statutory withholding taxes.

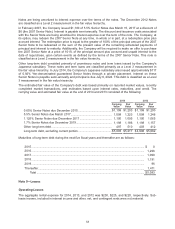

In conjunction with the special cash dividend discussed in Note 6, adjustments were made to awards

outstanding on the dividend record date to preserve their value following the dividend, as follows: (i) the

number of shares subject to outstanding RSUs was increased; and (ii) the exercise prices of outstanding

stock options were reduced and the number of shares subject to such options was increased.

Approximately 2,905,000 stock options were adjusted by 221,000 shares, and approximately 9,676,000

RSUs were adjusted by 732,000 shares. These adjustments did not result in additional stock-based

compensation expense, as the fair value of the outstanding awards did not change. As further required by

the Sixth Plan, the maximum number of shares issuable under the Sixth Plan was also proportionally

adjusted, which resulted in an additional 1,362,000 shares (778,000 RSUs) available to be granted.

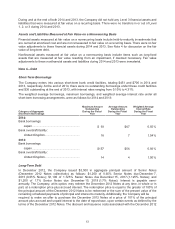

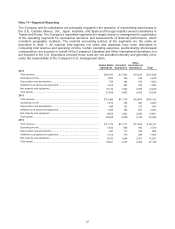

Summary of Restricted Stock Unit Activity

RSUs granted to employees and to non-employee directors generally vest over five years and three

years, respectively; however, the terms of the RSUs provide for accelerated vesting for employees and

non-employee directors who have attained 25 or more years and five or more years of service with the

Company, respectively, and provides for vesting upon certain terminations of employment or service.

Recipients are not entitled to vote or receive dividends on non-vested and undelivered shares. At the end

of 2014, 7,972,000 shares were available to be granted as RSUs under the Sixth Plan.

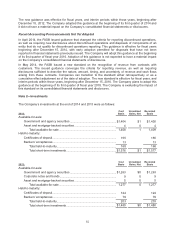

The following awards were outstanding at the end of 2014:

• 8,505,000 time-based RSUs that vest upon continued employment over specified periods of time;

• 612,000 performance-based RSUs, of which 269,000 were granted to executive officers subject to

the certification of the attainment of specified performance targets for 2014. This certification

occurred in September 2014, at which time a portion vested as a result of the long service of all

executive officers. The awards are subject to future time-based and long-service vesting.

60