Costco 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

included in this Report for discussion of accelerated vesting. Warehouse operating costs were lower by

one basis point, primarily resulting from improvements in payroll in our Canadian operations as a result of

leveraging increased sales, partially offset by increases in employee benefit costs, primarily health care,

in our U.S. operations. Changes in foreign currencies relative to the U.S. dollar decreased our SG&A

expenses by $119 in 2014.

2013 vs. 2012

SG&A expenses as a percentage of net sales increased one basis point. This increase was driven by

higher stock compensation expense of three basis points, partially offset by contributions made to an

initiative reforming alcohol beverage laws in Washington State in the first quarter of 2012, with no

comparable charge in 2013, which resulted in a positive impact of two basis points. Central operating

costs as a percent of net sales were flat, primarily due to the benefit of lower non-equity incentive

compensation costs as a result of not meeting certain internal performance targets. This was offset by

higher central operating costs, predominately related to the continued investment in modernizing our

information systems, primarily incurred by our U.S. operations. Warehouse operating costs as a

percentage of net sales were flat, primarily due to leveraging payroll costs in our U.S. and Canadian

operations as a result of increased net sales which was offset by increases in other operating costs,

primarily employee benefits and workers' compensation.

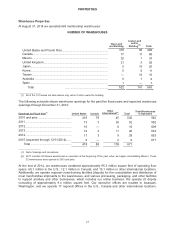

Preopening Expenses

2014 2013 2012

Preopening expenses .......................................................................................

.

$63

$ 51

$37

Warehouse openings, including relocations

United States ..............................................................................................

.

17

12

10

Canada ........................................................................................................

.

3

3

1

Other International .....................................................................................

.

10

11 6

Total warehouse openings, including relocations .........................................

.

30

26

17

Preopening expenses include costs for startup operations related to new warehouses, development in

new international markets, and expansions at existing warehouses. Preopening expenses vary due to the

number of warehouse openings, the timing of the opening relative to our year-end, whether the

warehouse is owned or leased, and whether the opening is in an existing, new, or international market.

During the fourth quarter we opened our first warehouse in Spain.

Interest Expense

2014 2013 2012

Interest ex

p

ense .................................................................................. $113 $99

$ 95

Interest expense in 2014 primarily relates to our $1,100 of 5.5% Senior Notes issued in fiscal 2007 and

our $3,500 of Senior notes issued in December 2012 (described in further detail under the heading “Cash

Flows from Financing Activities” and in Note 4 to the consolidated financial statements included in this

Report).

Interest Income and Other, Net

2014 2013 2012

Interest income .......................................................................................

.

$52 $44

$

49

Foreign-currency transaction gains, net .............................................

.

26 39

40

Other, net.................................................................................................

.

12 14

14

Interest income and other, net ......................................................

.

$

90

$

97

$

103

30