Costco 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

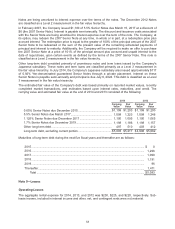

During and at the end of both 2014 and 2013, the Company did not hold any Level 3 financial assets and

liabilities that were measured at fair value on a recurring basis. There were no transfers in or out of Level

1, 2, or 3 during 2014 and 2013.

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Financial assets measured at fair value on a nonrecurring basis include held-to-maturity investments that

are carried at amortized cost and are not remeasured to fair value on a recurring basis. There were no fair

value adjustments to these financial assets during 2014 and 2013. See Note 4 for discussion on the fair

value of long-term debt.

Nonfinancial assets measured at fair value on a nonrecurring basis include items such as long-lived

assets that are measured at fair value resulting from an impairment, if deemed necessary. Fair value

adjustments to these nonfinancial assets and liabilities during 2014 and 2013 were immaterial.

Note 4—Debt

Short-Term Borrowings

The Company enters into various short-term bank credit facilities, totaling $451 and $700 in 2014 and

2013, respectively. At the end of 2014, there were no outstanding borrowings under these credit facilities

and $36 outstanding at the end of 2013, with interest rates ranging from 0.10% to 4.31%.

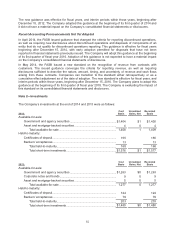

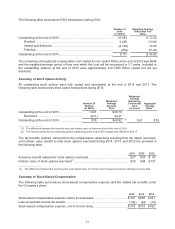

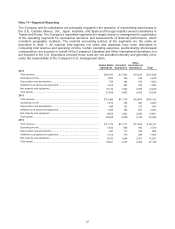

The weighted average borrowings, maximum borrowings, and weighted average interest rate under all

short-term borrowing arrangements, were as follows for 2014 and 2013:

Category of Aggregate

Short-term Borrowin

g

s

Maximum Amount

Outstanding

During the Fiscal

Y

ear

Average Amount

Outstanding

During the Fiscal

Y

ear

Weighted Average

Interest Rate

During the Fiscal

Y

ear

2014:

Bank borrowings:

Japan ...............................................................

.

$93 $67

0.55%

Bank overdraft facility:

United Kingdom ..............................................

.

18 7

1.54%

2013:

Bank borrowings:

Japan ...............................................................

.

$

157

$

56

0.56%

Bank overdraft facility:

United Kingdom ..............................................

.

14 4

1.50%

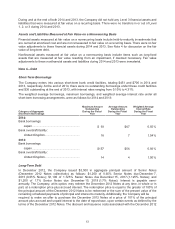

Long-Term Debt

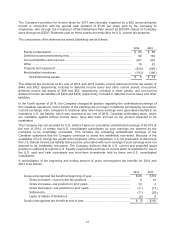

In December 2012, the Company issued $3,500 in aggregate principal amount of Senior Notes

(December 2012 Notes collectively) as follows: $1,200 of 0.65% Senior Notes due December 7,

2015 (0.65% Notes); $1,100 of 1.125% Senior Notes due December 15, 2017 (1.125% Notes); and

$1,200 of 1.7% Senior Notes due December 15, 2019 (1.7% Notes). Interest is payable semi-

annually. The Company, at its option, may redeem the December 2012 Notes at any time, in whole or in

part, at a redemption price plus accrued interest. The redemption price is equal to the greater of 100% of

the principal amount of the December 2012 Notes to be redeemed or the sum of the present value of the

remaining scheduled payments of principal and interest to maturity. Additionally, the Company will be

required to make an offer to purchase the December 2012 Notes at a price of 101% of the principal

amount plus accrued and unpaid interest to the date of repurchase, upon certain events as defined by the

terms of the December 2012 Notes. The discount and issuance costs associated with the December 2012

57