Costco 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

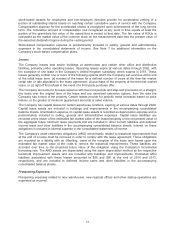

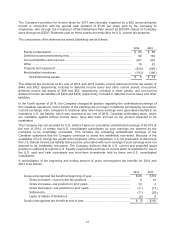

The Company’s provision for income taxes for 2013 was favorably impacted by a $62 nonrecurring tax

benefit in connection with the special cash dividend of $7.00 per share paid by the Company to

employees, who through the Company's 401(k) Retirement Plan owned 22,600,000 shares of Company

stock through an ESOP. Dividends paid on these shares are deductible for U.S. income tax purposes.

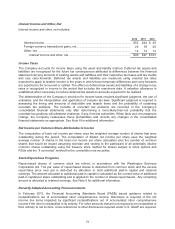

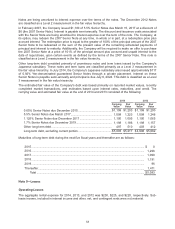

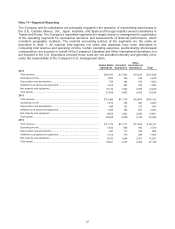

The components of the deferred tax assets (liabilities) are as follows:

2014 2013

E

q

uit

y

com

p

ensation ...........................................................................................................

.

$ 85

$80

Deferred income/membership fees ...................................................................................

.

98

130

Accrued liabilities and reserves .........................................................................................

.

607

530

Other ......................................................................................................................................

.

19

42

Property and equipment .....................................................................................................

.

(

529

)

(

558

)

Merchandise inventories .....................................................................................................

.

(

193

)

(

190

)

Net deferred tax assets ................................................................................................

.

$

8

$

34

The deferred tax accounts at the end of 2014 and 2013 include current deferred income tax assets of

$448 and $422 respectively, included in deferred income taxes and other current assets; non-current

deferred income tax assets of $68 and $62, respectively, included in other assets; and non-current

deferred income tax liabilities of $429 and $450, respectively, included in deferred income taxes and other

liabilities.

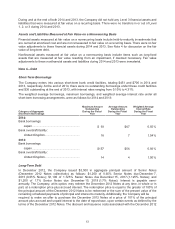

In the fourth quarter of 2014, the Company changed its position regarding the undistributed earnings of

the Canadian operations, and a portion of the earnings are no longer considered permanently reinvested.

Current exchange rates compared to historical rates when these earnings were generated resulted in an

immaterial U.S. tax liability, which was recorded at the end of 2014. Canadian withholding taxes, which

are creditable against federal income taxes, have also been accrued on the amount expected to be

repatriated.

The Company has not provided for U.S. deferred taxes on cumulative undistributed earnings of $3,619 at

the end of 2014, of certain non-U.S. consolidated subsidiaries as such earnings are deemed by the

Company to be indefinitely reinvested. This includes the remaining undistributed earnings of the

Canadian operations that the Company continues to assert are indefinitely reinvested. Because of the

availability of U.S. foreign tax credits and complexity of the computation, it is not practicable to determine

the U.S. federal income tax liability that would be associated with such earnings if such earnings were not

deemed to be indefinitely reinvested. The Company believes that its U.S. current and projected asset

position is sufficient to meet its U.S. liquidity requirements and has no current plans to repatriate for use in

the U.S. cash and cash equivalents and short-term investments held by these non-U.S. consolidated

subsidiaries.

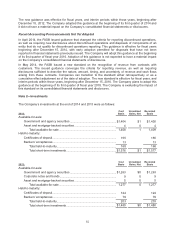

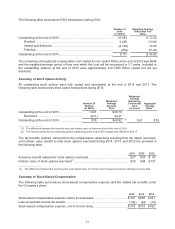

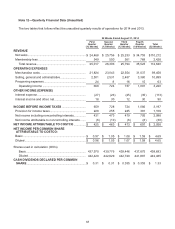

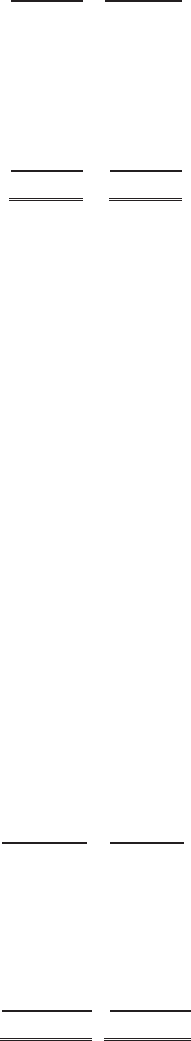

A reconciliation of the beginning and ending amount of gross unrecognized tax benefits for 2014 and

2013 is as follows:

2014 2013

Gross unreco

g

nized tax benefit at be

g

innin

g

of

y

ear...................................................

.

$ 80

$116

Gross increases—current year tax positions ..........................................................

.

9

10

Gross increases—tax positions in prior years ........................................................

.

10

5

Gross decreases—tax positions in prior years .......................................................

.

(

11

)

(

13

)

Settlements ..................................................................................................................

.

(

11

)

(

38

)

Lapse of statute of limitations ...................................................................................

.

(

2

)

0

Gross unreco

g

nized tax benefit at end of

y

ear..............................................................

.

$ 75

$

80

63