Costco 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 vs. 2013

The increase in interest income in 2014 was primarily driven by higher average cash, cash equivalents,

and short-term investments balances, primarily in our U.S. operations. The decrease in net foreign-

currency transaction gains was primarily attributable to the revaluation or settlement of monetary assets

and monetary liabilities during the year, primarily our Japanese subsidiary's U.S. dollar-denominated

payables. See Derivatives and Foreign Currency sections in Note 1 to the consolidated financial

statements included in this Report.

2013 vs. 2012

The decrease in interest income in 2013 was primarily attributable to lower interest rates earned on our

U.S. cash balances. There was a decrease in the positive impact of net foreign-currency transaction gains

resulting from the revaluation or settlement of monetary assets and monetary liabilities during the year.

This was partially offset by a positive impact of mark-to-market adjustments related to foreign exchange

contracts entered into by our foreign subsidiaries, as the U.S. dollar was slightly stronger in certain

international locations compared to 2012.

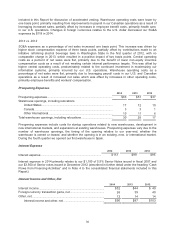

Provision for Income Taxes

2014 2013 2012

Provision for income taxes ................................................................ $1,109 $ 990

$1,000

Effective tax rate.................................................................................. 34.7 % 32.4 % 36.1%

Our provision for income taxes for 2013 was favorably impacted by nonrecurring net tax benefits of $77,

primarily due to a $62 tax benefit recorded in connection with the special cash dividend paid to employees

through our 401(k) Retirement Plan. Dividends paid on these shares are deductible for U.S. income tax

purposes.

LIQUIDITY AND CAPITAL RESOURCES

The following table summarizes our significant sources and uses of cash and cash equivalents:

2014 2013 2012

Net cash

p

rovided b

y

o

p

eratin

g

activities......................................

.

$ 3,984 $ 3,437

$ 3,057

Net cash used in investing activities ..............................................

.

(

2,093

)

(

2,251

)

(

1,236

)

Net cash (used in) provided by financing activities ......................

.

(

786

)

44

(

2,281

)

Our primary sources of liquidity are cash flows generated from warehouse operations, cash and cash

equivalents and short-term investment balances. Cash and cash equivalents and short-term investments

were $7,315 and $6,124 at the end of 2014 and 2013, respectively. Of these balances, approximately

$1,383 and $1,254 at the end of 2014 and 2013, respectively, represented debit and credit card

receivables, primarily related to sales in the last week of our fiscal year.

In the fourth quarter of 2014, we changed our position regarding a portion of the undistributed earnings of

our Canadian operations, which is no longer considered permanently reinvested. Current exchange rates

compared to historical rates when these earnings were generated resulted in an immaterial U.S. tax

liability, which was recorded at the end of 2014. Canadian withholding taxes, which are creditable against

federal income taxes, have also been accrued on the amount expected to be repatriated.

Management believes that our cash position and operating cash flows will be sufficient to meet our capital

requirements for the foreseeable future. We have not provided for U.S. deferred taxes on cumulative

undistributed earnings of certain non-U.S. consolidated subsidiaries as we deem such earnings to be

indefinitely reinvested. This includes the remaining undistributed earnings of our Canadian operations that

management continues to assert are indefinitely reinvested. We believe that our U.S. current and

31