Costco 2014 Annual Report Download - page 55

Download and view the complete annual report

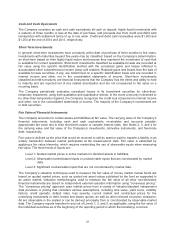

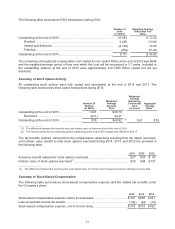

Please find page 55 of the 2014 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.stock-based awards for employees and non-employee directors provide for accelerated vesting of a

portion of outstanding shares based on reaching certain cumulative years of service with the Company.

Compensation expense for the accelerated shares is recognized upon achievement of the long service

term. The cumulative amount of compensation cost recognized at any point in time equals at least the

portion of the grant-date fair value of the award that is vested at that date. The fair value of RSUs is

calculated as the market value of the common stock on the measurement date less the present value of

the expected dividends forgone during the vesting period.

Stock-based compensation expense is predominantly included in selling, general and administrative

expenses in the consolidated statements of income. See Note 7 for additional information on the

Company’s stock-based compensation plans.

Leases

The Company leases land and/or buildings at warehouses and certain other office and distribution

facilities, primarily under operating leases. Operating leases expire at various dates through 2062, with

the exception of one lease in the Company’s United Kingdom subsidiary, which expires in 2151. These

leases generally contain one or more of the following options which the Company can exercise at the end

of the initial lease term: (a) renewal of the lease for a defined number of years at the then-fair market

rental rate or rate stipulated in the lease agreement; (b) purchase of the property at the then-fair market

value; or (c) right of first refusal in the event of a third-party purchase offer.

The Company accounts for its lease expense with free rent periods and step-rent provisions on a straight-

line basis over the original term of the lease and any exercised extension options, from the date the

Company has control of the property. Certain leases provide for periodic rental increases based on price

indices, or the greater of minimum guaranteed amounts or sales volume.

The Company has capital leases for certain warehouse locations, expiring at various dates through 2040.

Capital lease assets are included in buildings and improvements in the accompanying consolidated

balance sheets. Amortization expense on capital lease assets is recorded as depreciation expense and is

predominately included in selling, general and administrative expenses. Capital lease liabilities are

recorded at the lesser of the estimated fair market value of the leased property or the net present value of

the aggregate future minimum lease payments and are included in other current liabilities and deferred

income taxes and other liabilities in the accompanying consolidated balance sheets. Interest on these

obligations is included in interest expense in the consolidated statements of income.

The Company’s asset retirement obligations (ARO) are primarily related to leasehold improvements that

at the end of a lease must be removed in order to comply with the lease agreement. These obligations

are recorded as a liability with an offsetting asset at the inception of the lease term based upon the

estimated fair market value of the costs to remove the leasehold improvements. These liabilities are

accreted over time to the projected future value of the obligation using the Company’s incremental

borrowing rate. The ARO assets are depreciated using the same depreciation method as the respective

leasehold improvement assets and are included with buildings and improvements. Estimated ARO

liabilities associated with these leases amounted to $55 and $50 at the end of 2014 and 2013,

respectively, and are included in deferred income taxes and other liabilities in the accompanying

consolidated balance sheets.

Preopening Expenses

Preopening expenses related to new warehouses, new regional offices and other startup operations are

expensed as incurred.

53