Costco 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The new guidance was effective for fiscal years, and interim periods within those years, beginning after

December 15, 2012. The Company adopted this guidance at the beginning of its first quarter of 2014 and

it did not have a material impact on the Company’s consolidated financial statements or disclosures.

Recent Accounting Pronouncements Not Yet Adopted

In April 2014, the FASB issued guidance that changed the criteria for reporting discontinued operations,

as well as requiring new disclosures about discontinued operations and disposals of components of an

entity that do not qualify for discontinued operations reporting. This guidance is effective for fiscal years

beginning after December 15, 2014, with early adoption permitted for disposals that have not been

reported in financial statements previously issued. The Company will adopt this guidance at the beginning

of its first quarter of fiscal year 2016. Adoption of this guidance is not expected to have a material impact

on the Company’s consolidated financial statements or disclosures.

In May 2014, the FASB issued a new standard on the recognition of revenue from contracts with

customers. The issued guidance converges the criteria for reporting revenue, as well as requiring

disclosures sufficient to describe the nature, amount, timing, and uncertainty of revenue and cash flows

arising from these contracts. Companies can transition to the standard either retrospectively or as a

cumulative effect adjustment as of the date of adoption. The new standard is effective for fiscal years, and

interim periods within those years, beginning after December 15, 2016. The Company plans to adopt this

guidance at the beginning of its first quarter of fiscal year 2018. The Company is evaluating the impact of

this standard on its consolidated financial statements and disclosures.

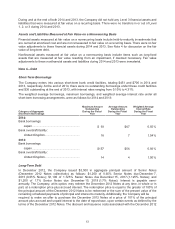

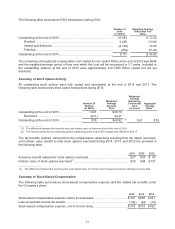

Note 2—Investments

The Company’s investments at the end of 2014 and 2013 were as follows:

2014:

Cost

Basis Unrealized

Gains, Net Recorded

Basis

A

vailable-for-sale:

Government and agency securities .............................................................

.

$1,404

$ 1

$1,405

Asset and mortgage-backed securities .......................................................

.

4

0

4

Total available-for-sale ............................................................................

.

1,408

1

1,409

Held-to-maturity:

Certificates of deposit .....................................................................................

.

155

155

Bankers' acceptances ....................................................................................

.

13

13

Total held-to-maturit

y

...............................................................................

.

168

168

Total short-term investments ..................................................................

.

$

1,576

$ 1

$

1,577

2013:

Cost

Basis Unrealized

Gains, Net Recorded

Basis

A

vailable-for-sale:

Government and agency securities .............................................................

.

$

1,263

$ 0

$

1,263

Corporate notes and bonds ...........................................................................

.

9

0

9

Asset and mortgage-backed securities .......................................................

.

5

0

5

Total available-for-sale ............................................................................

.

1,277

0

1,277

Held-to-maturity:

Certificates of deposit .....................................................................................

.

124

124

Bankers' acceptances ....................................................................................

.

79

79

Total held-to-maturit

y

...............................................................................

.

203

203

Total short-term investments ..................................................................

.

$

1,480

$ 0

$

1,480

55