Costco 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Bank Credit Facilities and Commercial Paper Programs

We maintain bank credit facilities for working capital and general corporate purposes. At August 31, 2014,

we had borrowing capacity within these facilities of $451, of which $381 was maintained by our

international operations. Of the $381, $180 is guaranteed by the Company. There were no outstanding

short-term borrowings under the bank credit facilities at the end of 2014 and $36 outstanding at the end of

2013.

The Company has letter of credit facilities, for commercial and standby letters of credit, totaling $154. The

outstanding commitments under these facilities at the end of 2014 totaled $95, including $91 in standby

letters of credit with expiration dates within one year. The bank credit facilities have various expiration

dates, all within one year, and we generally intend to renew these facilities prior to their expiration. The

amount of borrowings available at any time under our bank credit facilities is reduced by the amount of

standby and commercial letters of credit then outstanding.

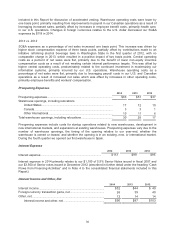

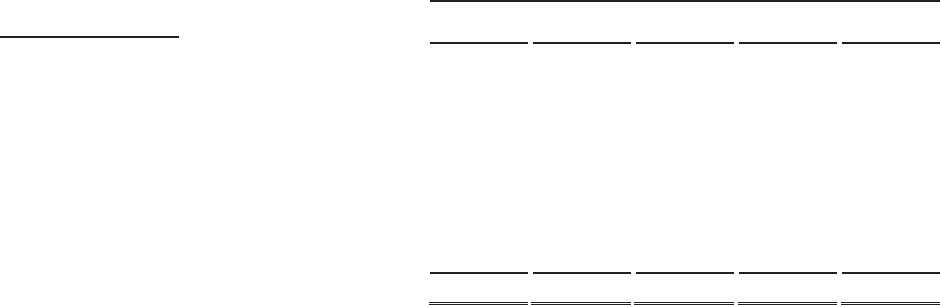

Contractual Obligations

As of August 31, 2014, our commitments to make future payments under contractual obligations were as

follows:

Pa

y

ments Due b

y

Fiscal Year

Contractual obli

g

ations 2015

2016 to

2017

2018 to

2019 2020 and

thereafter Total

Purchase obligations (merchandise)(1) ..................

$

5,671

$

4

$

—

$

—

$

5,675

Long-term debt(2) ....................................................... 107 2,598 1,348

1,432

5,485

Operating leases (3) .................................................. 196 382 353

2,127

3,058

Purchase obligations (property, equipment,

services and other)(4) ............................................ 414 64 3

—

481

Capital lease obligations(2) ....................................... 17 32 34

327

410

Construction commitments ...................................... 240 —

—

—

240

Other(5) ........................................................................ —2916

58

103

Total ............................................................................. $6,645 $ 3,109 $1,754

$ 3,944

$15,452

_______________

(1) Includes only open merchandise purchase orders.

(2) Includes contractual interest payments.

(3) Operating lease obligations exclude amounts for common area maintenance, taxes, and insurance and have been reduced

by $149 to reflect sub-lease income.

(4) The amounts exclude certain services negotiated at the individual warehouse or regional level that are not significant and

generally contain clauses allowing for cancellation without significant penalty.

(5) Includes $55 in asset retirement obligations and $48 in deferred compensation obligations. The total amount excludes $54 of

non-current unrecognized tax contingencies and $25 of other obligations due to uncertainty regarding the timing of future

cash payments.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that in the opinion of management have had, or are

reasonably likely to have, a material current or future effect on our financial condition or consolidated

financial statements.

Critical Accounting Estimates

The preparation of our consolidated financial statements in accordance with U.S. generally accepted

accounting principles (U.S. GAAP) requires that we make estimates and judgments. We continue to

33