Costco 2014 Annual Report Download - page 49

Download and view the complete annual report

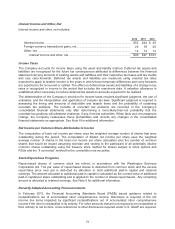

Please find page 49 of the 2014 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash and Cash Equivalents

The Company considers as cash and cash equivalents all cash on deposit, highly liquid investments with

a maturity of three months or less at the date of purchase, and proceeds due from credit and debit card

transactions with settlement terms of up to one week. Credit and debit card receivables were $1,383 and

$1,254 at the end of 2014 and 2013, respectively.

Short-Term Investments

In general, short-term investments have a maturity at the date of purchase of three months to five years.

Investments with maturities beyond five years may be classified, based on the Company’s determination,

as short-term based on their highly liquid nature and because they represent the investment of cash that

is available for current operations. Short-term investments classified as available-for-sale are recorded at

fair value using the specific identification method with the unrealized gains and losses reflected in

accumulated other comprehensive income (loss) until realized. Realized gains and losses from the sale of

available-for-sale securities, if any, are determined on a specific identification basis and are recorded in

interest income and other, net in the consolidated statements of income. Short-term investments

classified as held-to-maturity are financial instruments that the Company has the intent and ability to hold

to maturity and are reported net of any related amortization and are not remeasured to fair value on a

recurring basis.

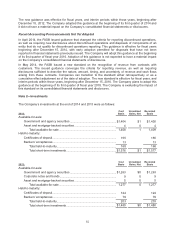

The Company periodically evaluates unrealized losses in its investment securities for other-than-

temporary impairment, using both qualitative and quantitative criteria. In the event a security is deemed to

be other-than-temporarily impaired, the Company recognizes the credit loss component in interest income

and other, net in the consolidated statements of income. The majority of the Company’s investments are

in debt securities.

Fair Value of Financial Instruments

The Company accounts for certain assets and liabilities at fair value. The carrying value of the Company’s

financial instruments, including cash and cash equivalents, receivables and accounts payable,

approximate fair value due to their short-term nature or variable interest rates. See Notes 2, 3, and 4 for

the carrying value and fair value of the Company’s investments, derivative instruments, and fixed-rate

debt, respectively.

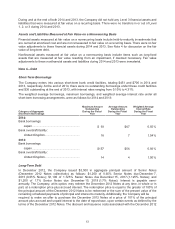

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date. Fair value is estimated by

applying a fair value hierarchy, which requires maximizing the use of observable inputs when measuring

fair value. The three levels of inputs are:

Level 1: Quoted market prices in active markets for identical assets or liabilities.

Level 2: Observable market-based inputs or unobservable inputs that are corroborated by market

data.

Level 3: Significant unobservable inputs that are not corroborated by market data.

The Company’s valuation techniques used to measure the fair value of money market mutual funds are

based on quoted market prices, such as quoted net asset values published by the fund as supported in

an active market. Valuation methodologies used to measure the fair value of all other non-derivative

financial instruments are based on independent external valuation information using “consensus pricing.”

The "consensus pricing" approach uses market prices from a variety of industry-standard independent

data providers or pricing that considers various assumptions, including time value, yield curve, volatility

factors, credit spreads, default rates, loss severity, current market and contractual prices for the

underlying instruments or debt, broker and dealer quotes, as well as other relevant economic measures.

All are observable in the market or can be derived principally from or corroborated by observable market

data. The Company reports transfers in and out of Levels 1, 2, and 3, as applicable, using the fair value of

the individual securities as of the beginning of the reporting period in which the transfer(s) occurred.

47