Costco 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

impact of one additional week of sales in 2012. Changes in foreign currencies relative to the U.S. dollar

negatively impacted net sales by approximately $208, or 21 basis points during 2013. The negative

impact was primarily due to the Japanese yen of approximately $354, partially offset by a positive impact

of the Mexican peso of approximately $127. Changes in gasoline prices were immaterial to the change in

net sales.

Comparable Sales

Comparable sales increased 6% during 2013 and were positively impacted by increases in both shopping

frequency and the average amount spent by our members. Changes in foreign currencies relative to the

U.S. dollar and gasoline prices were immaterial to the change in comparable sales. The increase in

comparable sales includes the negative impact of cannibalization.

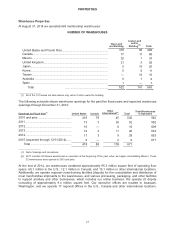

Membership Fees

2014 2013 2012

Membershi

p

fees ................................................................................ $2,428 $2,286

$2,075

Membership fees increase ................................................................ 6 % 10 % 11 %

Membership fees as a percentage of net sales .............................. 2.20 % 2.22 % 2.13%

2014 vs. 2013

Membership fees increased 6% in 2014. This increase was primarily due to membership sign-ups at

existing and new warehouses and increased number of upgrades to our higher-fee Executive

Membership program. The raising of our membership fees in fiscal 2012 positively impacted 2014 by $9.

These increases were partially offset by changes in foreign currencies relative to the U.S. dollar, which

negatively impacted membership fees by approximately $35 in 2014. Our member renewal rates are

currently 91% in the U.S. and Canada and 87% worldwide.

We increased our annual membership fees in the U.S. and Canada effective November 1, 2011, for new

members, and January 1, 2012, for renewal members. We account for membership fee revenue, net of

refunds, on a deferred basis, whereby revenue is recognized ratably over the one-year membership

period.

2013 vs. 2012

Membership fees increased 10% in 2013. The increase was primarily due to raising our annual

membership fees and membership sign-ups at both existing and new warehouses. The fee increase had

a positive impact on membership fee revenues of approximately $119 and $37 in 2013 and 2012,

respectively. These increases were partially offset by the impact of one additional week of membership

fees in 2012.

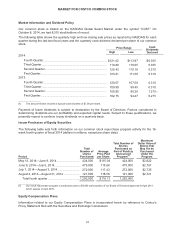

Gross Margin

2014 2013 2012

Net sales ................................................................................................... $110,212 $102,870

$ 97,062

Less merchandise costs ......................................................................... 98,458 91,948

86,823

Gross mar

g

in ............................................................................................

$

11,754

$

10,922

$

10,239

Gross margin as a percentage of net sales ......................................... 10.66 % 10.62 % 10.55%

2014 vs. 2013

Gross margin as a percentage of net sales increased four basis points. Gross margin in our core

merchandise categories (food and sundries, hardlines, softlines, and fresh foods) when expressed as a

percentage of net sales increased six basis points, primarily due to increases in our softlines and food

and sundries categories, partially offset by a decrease in hardlines. Fresh foods also had a positive

28