Costco 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

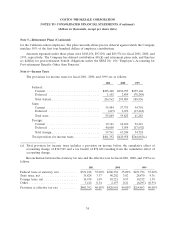

Note 6—Income Taxes (Continued)

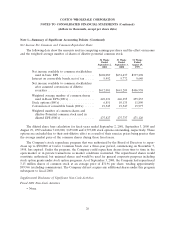

The components of the deferred tax assets and liabilities are as follows:

September 2, September 3,

2001 2000

Accrued liabilities .............................. $136,987 $118,385

Deferred membership fees ........................ 111,391 108,331

Other ....................................... 17,776 7,414

Total deferred tax assets ........................ 266,154 234,130

Property and equipment .......................... 127,243 98,149

Merchandise inventories .......................... 40,601 37,063

Other ....................................... 40,976 297

Total deferred tax liabilities ...................... 208,820 135,509

Net deferred tax assets ........................... $ 57,334 $ 98,621

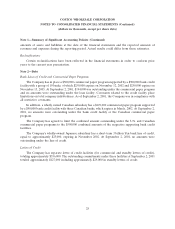

The deferred tax accounts at September 2, 2001 and September 3, 2000 include current deferred

income tax assets of $160,662 and $179,007, respectively, and non-current deferred income tax liabilities of

$103,328 and $80,386, respectively. Current deferred income tax assets are included in other current assets.

Note 7—Commitments and Contingencies

Legal Proceedings

The Company is involved from time to time in claims, proceedings and litigation arising from its

business and property ownership. The Company does not believe that any such claim, proceeding or

litigation, either alone or in the aggregate, will have a material adverse effect on the Company’s financial

position or results of its operations.

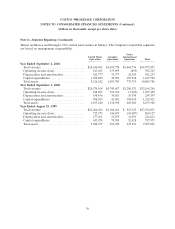

Note 8—Segment Reporting

The Company and its subsidiaries are principally engaged in the operation of membership warehouses

in the United States, Canada, Japan and through majority-owned subsidiaries in the United Kingdom,

35