Costco 2001 Annual Report Download - page 15

Download and view the complete annual report

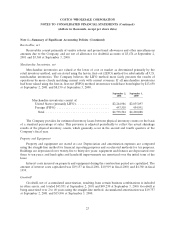

Please find page 15 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ventures. These expenditures will be financed with a combination of cash provided from operations, the

use of cash and cash equivalents and short-term investments, short-term borrowings under revolving credit

facilities and other financing sources as required.

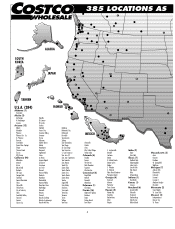

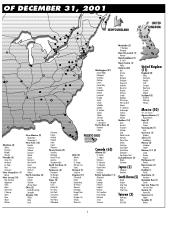

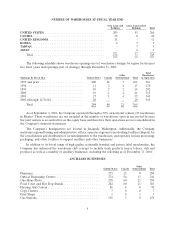

Expansion plans for the United States and Canada during fiscal 2002 are to open approximately 34 to

36 new warehouse clubs, including six to seven relocations to larger and better-located warehouses. The

Company expects to continue expansion of its international operations and plans to open two to three

additional units in the United Kingdom through its 80%-owned subsidiary, and one additional unit in

Korea through its 96%-owned subsidiary. Other international markets are being assessed.

Costco and its Mexico-based joint venture partner, Controladora Comercial Mexicana, each own a

50% interest in Costco Mexico. As of September 2, 2001, Costco Mexico operated 20 warehouses in

Mexico and plans to open one or two new warehouse clubs during fiscal 2002.

Reorganization of Canadian Administrative Operations

On January 17, 2001, the Company announced plans to reorganize and consolidate the administration

of its operations in Canada. Anticipated costs related to the reorganization are estimated to total $26,000

pre-tax ($15,600 after-tax, or $.03 per diluted share), expensed as incurred in fiscal 2001 and to be incurred

in the first quarter of fiscal 2002. During the current year the Company expensed $19,000 related to this

reorganization and consolidation process and has reported this charge as part of the provision for impaired

assets and closing costs.

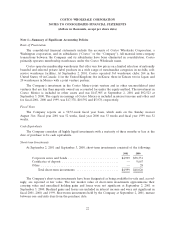

Bank Credit Facilities and Commercial Paper Programs (all amounts stated in thousands of US dollars)

The Company has in place a $500,000 commercial paper program supported by a $500,000 bank credit

facility with a group of 10 banks, of which $250,000 expires on November 12, 2002 and $250,000 expires on

November 15, 2005. At September 2, 2001, $194,000 was outstanding under the commercial paper program

and no amounts were outstanding under the loan facility.

In addition, a wholly owned Canadian subsidiary has a $129,000 commercial paper program supported

by a $90,000 bank credit facility with three Canadian banks, which expires in March, 2002. At September 2,

2001, no amounts were outstanding under the bank credit facility or the Canadian commercial paper

program.

The Company has agreed to limit the combined amount outstanding under the U.S. and Canadian

commercial paper programs to the $590,000 combined amounts of the respective supporting bank credit

facilities.

The Company’s wholly-owned Japanese subsidiary has a short-term 3 billion Yen bank line of credit,

equal to approximately $25,000, expiring in November 2002. At September 2, 2001, no amounts were

outstanding under the line of credit.

Letters of Credit

The Company has separate letter of credit facilities (for commercial and standby letters of credit),

totaling approximately $556,000. The outstanding commitments under these facilities at September 2, 2001

totaled approximately $127,000, including approximately $29,000 in standby letters of credit.

Financing Activities

During April 2001, the Company retired its unsecured note payable to banks of $140,000 using cash

provided from operations, cash and cash equivalents and short-term borrowings under its commercial

paper program.

13