Costco 2001 Annual Report Download - page 16

Download and view the complete annual report

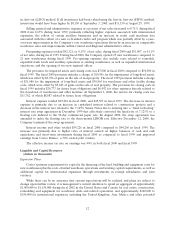

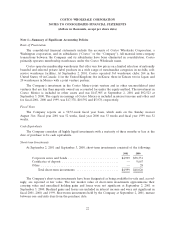

Please find page 16 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In October 2000, the Company’s wholly-owned Japanese subsidiary issued 2.070% promissory notes in

the aggregate amount of 3.5 billion Yen, equal to $29,400, through a private placement. Interest is payable

annually and principal is due on October 23, 2007.

In July 2001, the Company’s wholly-owned Japanese subsidiary issued 1.187% promissory notes in the

aggregate amount of 3 billion Yen, equal to $25,200, through a private placement. Interest is payable semi-

annually and principal is due on July 9, 2008.

In February 1996, the Company filed with the Securities and Exchange Commission a shelf registra-

tion statement for $500,000 of senior debt securities. To date, no securities have been issued under this

filing. On October 23, 2001, subsequent to fiscal 2001 year end, the Company filed with the Securities and

Exchange Commission to offer up to an additional $100,000 in debt securities, bringing the total amount of

debt securities registered under shelf registration to $600,000.

Derivatives

The Company has limited involvement with derivative financial instruments and uses them only to

manage well-defined interest rate and foreign exchange risks. Forward foreign exchange contracts are used

to hedge the impact of fluctuations of foreign exchange on inventory purchases. The amount of interest

rate and foreign exchange contracts outstanding at September 2, 2001 were not material to the Company’s

results of operations or its financial position. Effective December 10, 1999, the Company entered into a

‘‘fixed-to-floating’’ interest rate swap agreement on its $300,000 7.125% Senior Notes, replacing the fixed

interest rate with a floating rate indexed to the 30-day commercial paper rate. On August 11, 2000, the

swap agreement was amended to index the floating rate to the three-month LIBOR rate. Effective

December 12, 2000, the Company terminated the swap agreement, resulting in a gain of approximately

$5,000, the benefit of which is being amortized over the remaining term of the debt.

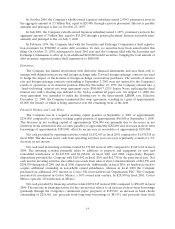

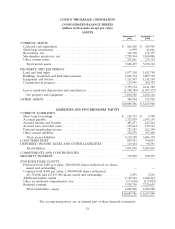

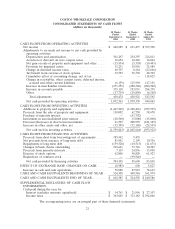

Financial Position and Cash Flows

The Company was in a negative working capital position at September 2, 2001 of approximately

$230,000, compared to a positive working capital position of approximately $66,000 at September 3, 2000.

The decrease in net working capital of approximately $296,000 was primarily due to decreases in net

inventory levels (inventories less accounts payable) of approximately $282,000 and increases in short term

borrowings of approximately $185,000, offset by an increase in receivables of approximately $150,000.

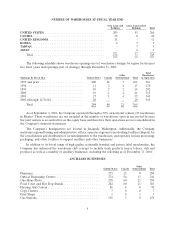

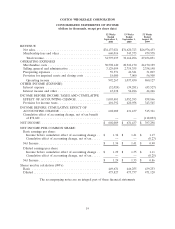

Net cash provided by operating activities totaled $1,032,563 in fiscal 2001 compared to $1,070,358 in

fiscal 2000. The decrease in net cash from operating activities year-over-year is primarily a result of a 5%

decrease in net income.

Net cash used in investing activities totaled $1,339,843 in fiscal 2001 compared to $1,045,664 in fiscal

2000. The investing activities primarily relate to additions to property and equipment for new and

remodeled warehouses of $1,447,549 and $1,228,421 in fiscal 2001 and 2000, respectively. Property

dispositions provided the Company with $110,002 in fiscal 2001 and $62,730 in the prior fiscal year. Net

cash used in investing activities also reflects proceeds from sales of short-term investments of $41,599 and

$208,959 during fiscal 2001 and fiscal 2000, respectively. Additionally, in fiscal 2001, no funds were used to

acquire additional ownership in non-wholly owned subsidiaries, whereas in fiscal 2000 the Company

purchased an additional 20% interest in Costco UK from Littlewoods Organisation PLC. The Company

increased its investment in Costco Mexico; a 50% owned joint venture, by $28,500 in fiscal 2001. Costco

Mexico operates 20 warehouses in Mexico.

Net cash provided by financing activities totaled $394,345 in fiscal 2001 compared to $58,605 in fiscal

2000. The increase in financing activity for the current year relates to an increase in short-term borrowings

(primarily through the Company’s commercial paper program) of $185,942, an increase in bank checks

outstanding of $216,661, net proceeds from long-term borrowings of $81,951 and proceeds from stock

14