Costco 2001 Annual Report Download - page 13

Download and view the complete annual report

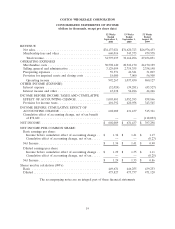

Please find page 13 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expenses also include costs related to remodels and expanded ancillary operations at existing warehouses,

as well as expanded international operations.

The provision for impaired assets and closing costs was $18,000 in fiscal 2001 compared to $7,000 in

fiscal 2000. The fiscal 2001 provision includes charges of $19,000 for the Canadian administrative

reorganization (See—‘‘Management’s Discussion and Analysis of Financial Condition and Results of

Operations’’—Liquidity and Capital Resources), $15,231 for the impairment of long-lived assets and

$2,412 for warehouse closing expense, which were offset by $18,643 of gains on the sale of real property. At

September 2, 2001, the reserve for warehouse closing costs was $15,434, of which $6,538 related to future

lease obligations. This compares to a reserve for warehouse closing costs of $11,762 at September 3, 2000,

of which $8,887 related to future lease obligations. (See—Notes to Consolidated Financial Statements—

Note 1).

Interest expense totaled $32,024 in fiscal 2001, and $39,281 in fiscal 2000. The decrease in interest

expense is primarily due to an increase in capitalized interest related to construction projects and a

decrease related to the retirement of an unsecured note payable to banks with a principal amount totaling

$140,000 in April 2001.

Interest income and other totaled $43,238 in fiscal 2001 compared to $54,226 in fiscal 2000. The

decrease was primarily due to lower rates of interest earned on lower balances of cash and cash equivalents

and short-term investments during fiscal 2001 as compared to fiscal 2000, which was partially offset by

improved earnings from Costco Mexico (a 50%-owned joint venture) on a year-over-year basis.

The effective income tax rate on earnings was 40% in both fiscal 2001 and fiscal 2000.

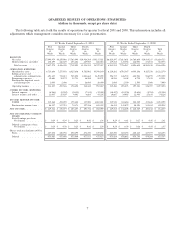

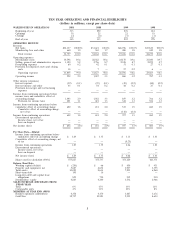

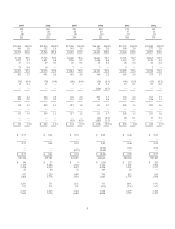

Comparison of Fiscal 2000 (53 weeks) and Fiscal 1999 (52 weeks):

(dollars in thousands, except earnings per share)

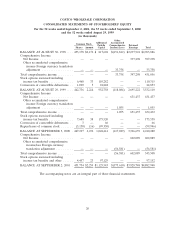

Net income for fiscal 2000, a 53-week fiscal year, increased 59% to $631,437, or $1.35 per diluted

share, from $397,298, or $0.86 per diluted share during fiscal year 1999, a 52-week fiscal year. Net income

for fiscal 1999 was impacted by both a $50,000 fourth quarter pre-tax provision for impaired assets and

warehouse closing costs, as well as the one-time $118,023 non-cash, after-tax charge recorded in the first

quarter of fiscal 1999, reflecting the cumulative effect of the Company’s change in accounting for

membership fees from a cash to a deferred method. Excluding the impact of these two charges, net income

in fiscal 1999 would have been $545,321, or $1.18 per diluted share and would have resulted in a 16%

increase in net income in fiscal 2000 compared to fiscal 1999.

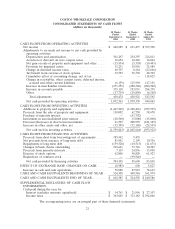

Net sales increased 17% to $31,620,723 in fiscal 2000 from $26,976,453 in fiscal 1999. This increase

was due to: (i) higher sales at existing locations opened prior to fiscal 1999; (ii) increased sales at 14

warehouses (21 opened, 7 closed) that were opened in fiscal 1999 and in operation for the entire 2000

fiscal year; (iii) first year sales at the 21 new warehouses opened (25 opened, 4 closed) during fiscal 2000;

and (iv) fiscal 2000 being a 53-week fiscal year. Changes in prices did not materially impact sales levels.

Comparable sales, that is sales in warehouses open for at least a year, increased at an 11% annual rate

in fiscal 2000 compared to a 10% annual rate during fiscal 1999.

Membership fees and other revenue increased 13% to $543,573, or 1.72% of net sales, in fiscal 2000

from $479,578, or 1.78% of net sales, in fiscal 1999. This increase was primarily due to membership sign-

ups at the 21 new warehouses opened in fiscal 2000.

Gross margin (defined as net sales minus merchandise costs) increased 18% to $3,298,553, or 10.43%

of net sales, in fiscal 2000 from $2,806,254, or 10.40% of net sales, in fiscal 1999. Gross margin as a

percentage of net sales increased due to increased sales penetration of certain higher gross margin

ancillary businesses and private label products and improved performance of the Company’s international

operations. The gross margin figures reflect accounting for most U.S. merchandise inventories on the last-

11