Costco 2001 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

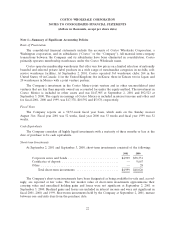

Note 1—Summary of Significant Accounting Policies (Continued)

Acquisition of Minority Interest

On May 26, 2000, the Company acquired from the Littlewoods Organisation PLC its 20% equity

interest in Costco Wholesale UK Limited, bringing the Company’s ownership in Costco Wholesale UK

Limited to 80%. The acquisition was funded with cash and cash equivalents on hand. Costco Wholesale

UK Limited currently operates eleven Costco warehouse locations.

Accounts Payable

The Company’s banking system provides for the daily replenishment of major bank accounts as checks

are presented. Accordingly, included in accounts payable at September 2, 2001 and September 3, 2000 are

$270,757 and $55,002 respectively, representing the excess of outstanding checks over cash on deposit at

the banks on which the checks were drawn.

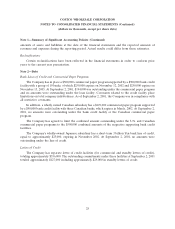

Derivatives

The Company has limited involvement with derivative financial instruments and only uses them to

manage well-defined interest rate and foreign exchange risks. Forward foreign exchange contracts are used

to hedge the impact of fluctuations of foreign exchange on inventory purchases. The amount of interest

rate and foreign exchange contracts outstanding at year-end or in place during fiscal 2001 and 2000 was

immaterial to the Company’s results of operations or its financial position.

Effective December 10, 1999, the Company entered into a ‘‘fixed-to-floating’’ interest rate swap

agreement on its $300,000 7.125% Senior Notes. Effective December 12, 2000, the Company terminated

the swap agreement resulting in a gain of approximately $5,000, which is being amortized over the

remaining term of the debt.

Foreign Currency Translations

Assets and liabilities recorded in foreign currencies, as well as the Company’s investment in the

Costco Mexico joint venture, are translated at the exchange rate on the balance sheet date. Translation

adjustments resulting from this process are charged or credited to other comprehensive income (loss).

Revenue and expenses of the Company’s consolidated foreign operations are translated at average rates of

exchange prevailing during the year. Gains and losses on foreign currency transactions are included in

expenses.

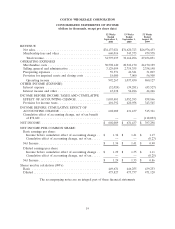

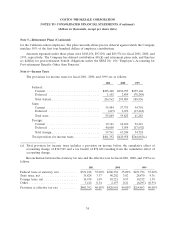

Membership Fees

Membership fee revenue represents annual membership fees paid by substantially all of the Com-

pany’s members. Effective with the first quarter of fiscal 1999, the Company changed its method of

accounting for membership fee income from a ‘‘cash basis’’ to a ‘‘deferred basis’’ whereby membership fee

income is recognized ratably over the one- year life of the membership. The change to the deferred

method of accounting for membership fees resulted in a one-time, non-cash, pre-tax charge of approxi-

mately $196,705 ($118,023 after-tax, or $.25 per diluted share) to reflect the cumulative effect of the

accounting change as of the beginning of fiscal 1999.

24