Costco 2001 Annual Report Download - page 17

Download and view the complete annual report

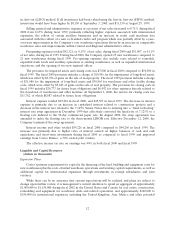

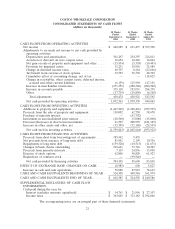

Please find page 17 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.option exercises of $62,000, offset by retirement of long-term debt in the current fiscal year of $159,328.

Included in this long-term debt retirement was the retirement of its $140,000 unsecured notes payable to

banks in April 2001.

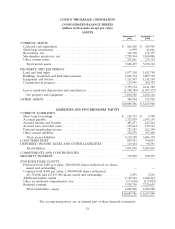

The Company’s balance sheet as of September 2, 2001 reflects a $1,455,846 or 17% increase in total

assets since September 3, 2000. The increase is primarily due to a net increase in property and equipment

and merchandise inventory related to the Company’s expansion program.

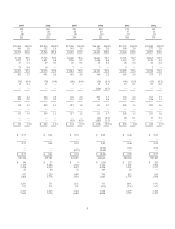

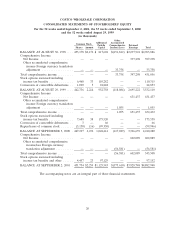

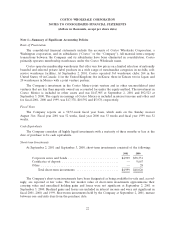

Stock Repurchase Program (dollars in thousands except per share data)

The Company’s stock repurchase program, that was authorized by the Board of Directors to

repurchase up to $500,000 of Costco Common Stock over a three-year period commencing on Novem-

ber 5, 1998, has expired. Under the program, the Company could repurchase shares from time to time in

the open market or in private transactions as market conditions warranted. The repurchased shares would

constitute authorized, but unissued shares and would be used for general corporate purposes including

stock option grants under stock option programs. As of September 3, 2000, the Company had repurchased

3.13 million shares of common stock at an average price of $31.96 per share, totaling approximately

$99,946 (excluding commissions). The Company did not acquire any additional shares under this program

subsequent to fiscal 2000.

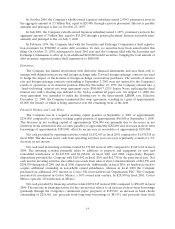

Membership Fee Increases

Effective September 1, 2000, the Company increased annual membership fees for its Gold Star

(individual), Business, and Business Add-on Members. These fee increases averaged approximately $5 per

member across its member categories.

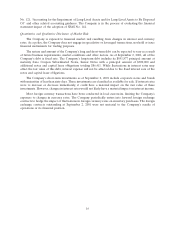

Recent Accounting Pronouncements

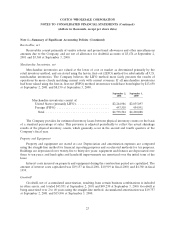

During June 1998, the Financial Accounting Standards Board (FASB) issued Statement of Financial

Accounting Standards (SFAS) No. 133, Accounting for Derivative and Hedging Activities, and in

June 2000 the FASB issued SFAS 138, Accounting for Certain Derivative Instruments and Certain Hedging

Activities, an amendment of SFAS 133. These standards require companies to record derivative financial

instruments on the balance sheet as assets or liabilities, measured at fair value. Gains or losses resulting

from changes in the fair value of those derivatives would be accounted for based on the use of the

derivative and whether the instrument qualified for hedge accounting, as defined in SFAS 133 and 138. The

Company was required to adopt the provisions of SFAS 133 and 138 on September 4, 2000, the first day of

fiscal 2001. The Company’s use of derivative instruments was limited to the fixed-to-floating swap contract

on its 7.125% Senior Notes, which was terminated on December 12, 2000, and foreign exchange contracts.

The impact of the adoption of this accounting standard in fiscal 2001 was not material.

In June 2001, the FASB issued SFAS No. 142, ‘‘Accounting for Goodwill and Other Intangibles’’,

which specifies that goodwill and some intangible assets will no longer be amortized, but instead will be

subject to periodic impairment testing. This pronouncement is effective for the Company beginning in

fiscal 2003, but may be adopted in fiscal 2002. The Company is in the process of evaluating the financial

statement impact of the adoption of SFAS No. 142.

In June 2001, the FASB issued SFAS No. 143, ‘‘Accounting for Asset Retirement Obligations,’’

effective for the Company on January 1, 2003. This Statement addresses financial accounting and reporting

for obligations associated with the retirement of tangible long-lived assets and the associated asset

retirement costs. The Company is in the process of evaluating the financial statement impact of the

adoption of SFAS No. 143.

In August 2001, the FASB issued SFAS No. 144, ‘‘Accounting for the Impairment or Disposal of Long-

Lived Assets,’’ effective for the Company on January 1, 2002. This Statement supersedes FASB Statement

15