Costco 2001 Annual Report Download - page 18

Download and view the complete annual report

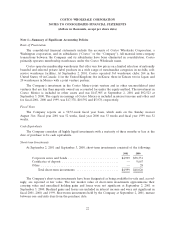

Please find page 18 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.No. 121, ‘‘Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to Be Disposed

Of’’ and other related accounting guidance. The Company is in the process of evaluating the financial

statement impact of the adoption of SFAS No. 144.

Quantitative and Qualitative Disclosure of Market Risk

The Company is exposed to financial market risk resulting from changes in interest and currency

rates. As a policy, the Company does not engage in speculative or leveraged transactions, nor hold or issue

financial instruments for trading purposes.

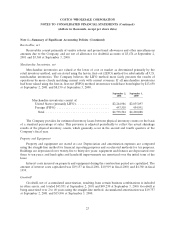

The nature and amount of the Company’s long and short-term debt can be expected to vary as a result

of future business requirements, market conditions and other factors. As of September 2, 2001, all of the

Company’s debt is fixed rate. The Company’s long-term debt includes its $851,877 principal amount at

maturity Zero Coupon Subordinated Notes, Senior Notes with a principal amount of $300,000 and

additional notes and capital lease obligations totaling $86,411. While fluctuations in interest rates may

affect the fair value of this debt, interest expense will not be affected due to the fixed interest rate of the

notes and capital lease obligations.

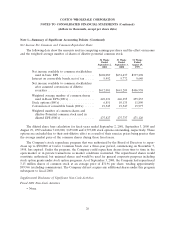

The Company’s short-term investments as of September 2, 2001 include corporate notes and bonds

with maturities of less than sixty days. These investments are classified as available for sale. If interest rates

were to increase or decrease immediately, it could have a material impact on the fair value of these

investments. However, changes in interest rates would not likely have a material impact on interest income.

Most foreign currency transactions have been conducted in local currencies, limiting the Company’s

exposure to changes in currency rates. The Company periodically enters into forward foreign exchange

contracts to hedge the impact of fluctuations in foreign currency rates on inventory purchases. The foreign

exchange contracts outstanding at September 2, 2001 were not material to the Company’s results of

operations or its financial position.

16