Costco 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

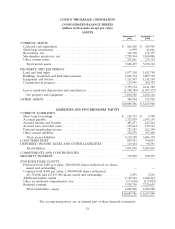

COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share data)

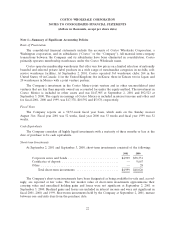

Note 1—Summary of Significant Accounting Policies

Basis of Presentation

The consolidated financial statements include the accounts of Costco Wholesale Corporation, a

Washington corporation, and its subsidiaries (‘‘Costco’’ or the ‘‘Company’’). All material inter-company

transactions between the Company and its subsidiaries have been eliminated in consolidation. Costco

primarily operates membership warehouses under the Costco Wholesale name.

Costco operates membership warehouses that offer very low prices on a limited selection of nationally

branded and selected private label products in a wide range of merchandise categories in no-frills, self-

service warehouse facilities. At September 2, 2001, Costco operated 365 warehouse clubs: 264 in the

United States; 60 in Canada; 11 in the United Kingdom; five in Korea; three in Taiwan; two in Japan; and

20 warehouses in Mexico with a joint venture partner.

The Company’s investment in the Costco Mexico joint venture and in other unconsolidated joint

ventures that are less than majority owned are accounted for under the equity method. The investment in

Costco Mexico is included in other assets and was $147,905 at September 2, 2001 and $92,523 at

September 3, 2000. The equity in earnings of Costco Mexico is included in interest income and other and

for fiscal 2001, 2000 and 1999, was $17,378, $10,592 and $5,978, respectively.

Fiscal Years

The Company reports on a 52/53-week fiscal year basis, which ends on the Sunday nearest

August 31st. Fiscal year 2001 was 52 weeks, fiscal year 2000 was 53 weeks and fiscal year 1999 was 52

weeks.

Cash Equivalents

The Company considers all highly liquid investments with a maturity of three months or less at the

date of purchase to be cash equivalents.

Short-term Investments

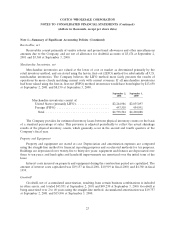

At September 2, 2001 and September 3, 2000, short-term investments consisted of the following:

2001 2000

Corporate notes and bonds ............................. $4,999 $38,331

Certificates of deposit ................................ — 9,667

Other ............................................ — 28

Total short-term investments ........................ $4,999 $48,026

The Company’s short-term investments have been designated as being available-for-sale and, accord-

ingly, are reported at fair value. The fair market value of short-term investments approximates their

carrying value and unrealized holding gains and losses were not significant at September 2, 2001 or

September 3, 2000. Realized gains and losses are included in interest income and were not significant in

fiscal 2001, 2000, and 1999. Short-term investments held by the Company at September 2, 2001, mature

between one and sixty days from the purchase date.

22