Costco 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

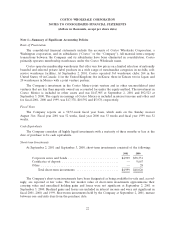

Note 1—Summary of Significant Accounting Policies (Continued)

Receivables, net

Receivables consist primarily of vendor rebates and promotional allowances and other miscellaneous

amounts due to the Company, and are net of allowance for doubtful accounts of $3,474 at September 2,

2001 and $3,368 at September 3, 2000.

Merchandise Inventories, net

Merchandise inventories are valued at the lower of cost or market as determined primarily by the

retail inventory method, and are stated using the last-in, first-out (LIFO) method for substantially all U.S.

merchandise inventories. The Company believes the LIFO method more fairly presents the results of

operations by more closely matching current costs with current revenues. If all merchandise inventories

had been valued using the first-in, first-out (FIFO) method, inventories would have been higher by $13,650

at September 2, 2001 and $8,150 at September 3, 2000.

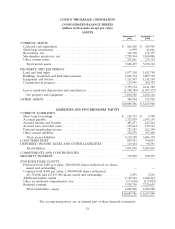

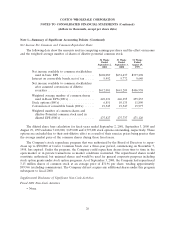

September 2, September 3,

2001 2000

Merchandise inventories consist of:

United States (primarily LIFO) ................... $2,244,986 $2,035,097

Foreign (FIFO) .............................. 493,518 454,991

Total .................................... $2,738,504 $2,490,088

The Company provides for estimated inventory losses between physical inventory counts on the basis

of a standard percentage of sales. This provision is adjusted periodically to reflect the actual shrinkage

results of the physical inventory counts, which generally occur in the second and fourth quarters of the

Company’s fiscal year.

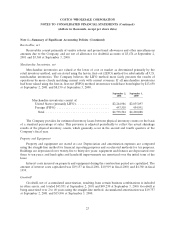

Property and Equipment

Property and equipment are stated at cost. Depreciation and amortization expenses are computed

using the straight-line method for financial reporting purposes and accelerated methods for tax purposes.

Buildings are depreciated over twenty-five to thirty-five years; equipment and fixtures are depreciated over

three to ten years; and land rights and leasehold improvements are amortized over the initial term of the

lease.

Interest costs incurred on property and equipment during the construction period are capitalized. The

amount of interest costs capitalized was $19,157 in fiscal 2001, $10,919 in fiscal 2000, and $4,380 in fiscal

1999.

Goodwill

Goodwill, net of accumulated amortization, resulting from certain business combinations is included

in other assets, and totaled $43,831 at September 2, 2001 and $49,230 at September 3, 2000. Goodwill is

being amortized over 2 to 40 years using the straight-line method. Accumulated amortization was $19,757

at September 2, 2001 and $15,896 at September 3, 2000.

23