Costco 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

Note 1—Summary of Significant Accounting Policies (Continued)

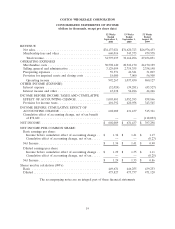

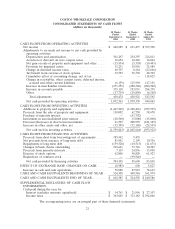

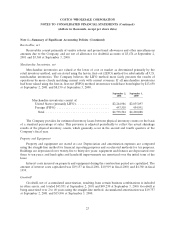

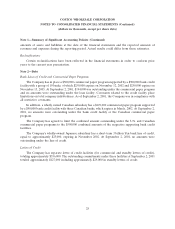

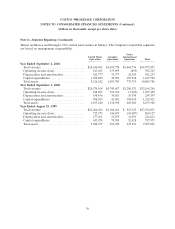

Net Income Per Common and Common Equivalent Share

The following data show the amounts used in computing earnings per share and the effect on income

and the weighted average number of shares of dilutive potential common stock.

52 Weeks 53 Weeks 52 Weeks

Ended Ended Ended

September 2, September 3, August 29,

2001 2000 1999

Net income available to common stockholders

used in basic EPS .................... $602,089 $631,437 $397,298

Interest on convertible bonds, net of tax ...... 9,992 9,772 9,640

Net income available to common stockholders

after assumed conversions of dilutive

securities ........................... $612,081 $641,209 $406,938

Weighted average number of common shares

used in Basic EPS (000’s) ............... 449,631 446,255 439,253

Stock options (000’s) .................... 6,851 10,135 11,890

Conversion of convertible bonds (000’s) ...... 19,345 19,347 19,977

Weighted number of common shares and

dilutive Potential common stock used in

diluted EPS (000’s) ................... 475,827 475,737 471,120

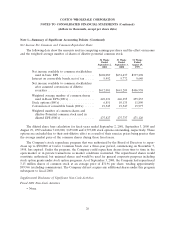

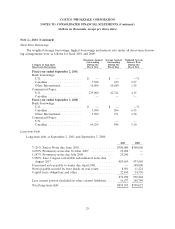

The diluted share base calculation for fiscal years ended September 2, 2001, September 3, 2000 and

August 29, 1999 excludes 7,108,000, 3,659,000 and 4,797,000 stock options outstanding, respectively. These

options are excluded due to their anti-dilutive effect as a result of their exercise prices being greater than

the average market price of the common shares during those fiscal years.

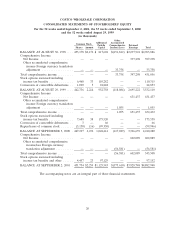

The Company’s stock repurchase program that was authorized by the Board of Directors to repur-

chase up to $500,000 of Costco Common Stock over a three-year period, commencing on November 5,

1998, has expired. Under the program, the Company could repurchase shares from time to time in the

open market or in private transactions as market conditions warranted. The repurchased shares would

constitute authorized, but unissued shares and would be used for general corporate purposes including

stock option grants under stock option programs. As of September 3, 2000, the Company had repurchased

3.13 million shares of common stock at an average price of $31.96 per share, totaling approximately

$99,946 (excluding commissions). The Company did not acquire any additional shares under this program

subsequent to fiscal 2000.

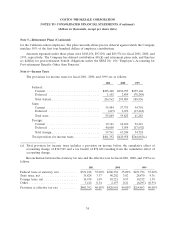

Supplemental Disclosure of Significant Non-Cash Activities

Fiscal 2001 Non-Cash Activities

• None.

26