Costco 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

Note 5—Retirement Plans (Continued)

for the California union employees. The plan currently allows pre-tax deferral against which the Company

matches 50% of the first four hundred dollars of employee contributions.

Amounts expensed under these plans were $108,256, $97,830, and $85,974 for fiscal 2001, 2000, and

1999, respectively. The Company has defined contribution 401(k) and retirement plans only, and thus has

no liability for post-retirement benefit obligations under the SFAS No. 106 ‘‘Employer’s Accounting for

Post-retirement Benefits Other than Pensions.’’

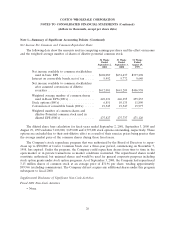

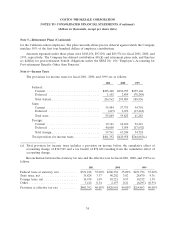

Note 6—Income Taxes

The provisions for income taxes for fiscal 2001, 2000, and 1999 are as follows:

2001 2000 1999

Federal:

Current .............................. $285,460 $290,995 $259,104

Deferred ............................. 1,102 2,894 (70,248)

Total federal ........................... 286,562 293,889 188,856

State:

Current .............................. 55,484 57,753 54,701

Deferred ............................. (415) 2,072 (13,418)

Total state ............................. 55,069 59,825 41,283

Foreign:

Current .............................. 19,161 64,210 52,416

Deferred ............................. 40,600 3,034 (17,692)

Total foreign ........................... 59,761 67,244 34,724

Total provision for income taxes .............. $401,392 $420,958 $264,863(a)

(a) Total provision for income taxes includes a provision on income before the cumulative effect of

accounting change of $343,545 and a tax benefit of $78,682 resulting from the cumulative effect of

accounting change.

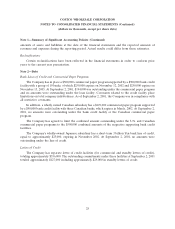

Reconciliation between the statutory tax rate and the effective rate for fiscal 2001, 2000, and 1999 is as

follows:

2001 2000 1999

Federal taxes at statutory rate .......... $351,218 35.00% $368,338 35.00% $231,756 35.00%

State taxes, net ..................... 35,824 3.57 40,202 3.82 28,870 4.36

Foreign taxes, net ................... 10,938 1.09 10,221 0.97 10,532 1.59

Other ............................ 3,412 0.34 2,197 0.21 (6,295) (0.95)

Provision at effective tax rate .......... $401,392 40.00% $420,958 40.00% $264,863 40.00%

34