Costco 2001 Annual Report Download - page 32

Download and view the complete annual report

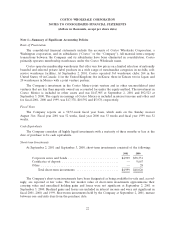

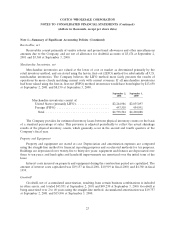

Please find page 32 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

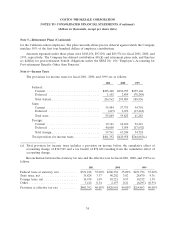

Note 2—Debt (Continued)

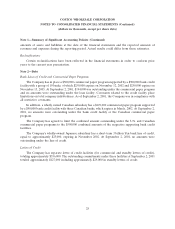

In June 1995, the Company issued $300,000 of 7.125% Senior Notes due June 15, 2005. Interest on the

notes is payable semiannually on June 15 and December 15. The indentures contain certain limitations on

the Company’s and certain subsidiaries’ ability to create liens securing indebtedness and to enter into

certain sale leaseback transactions. In December 1999, the Company entered into a ‘‘fixed-to-floating’’

interest rate swap agreement, which, as amended, replaced the fixed interest rate with a floating rate

indexed to LIBOR. In December 2000, the Company terminated the swap agreement, resulting in a gain of

approximately $5,000, which is being amortized over the remaining term of the debt. As of September 2,

2001, the Company was in compliance with all restrictive covenants.

In October 2000, the Company’s wholly-owned Japanese subsidiary issued 2.070% promissory notes in

the aggregate amount of 3.5 billion Yen, equal to $29,400, through a private placement. Interest is payable

annually and principal is due on October 23, 2007.

In July 2001, the Company’s wholly-owned Japanese subsidiary issued 1.187% promissory notes in the

aggregate amount of 3 billion Yen, equal to $25,200, through a private placement. Interest is payable

semi-annually and principal is due on July 9, 2008.

During April 2001, the Company retired its unsecured note payable to banks of $140,000 using cash

provided from operations, cash and cash equivalents, and short-term borrowings under its commercial

paper program.

On August 19, 1997, the Company completed the sale of $900,000 principal amount at maturity Zero

Coupon Subordinated Notes (the ‘‘Notes’’) due August 19, 2017. The Notes were priced with a yield to

maturity of 3.500%, resulting in gross proceeds to the Company of $449,640. The Notes are convertible

into a maximum of 20,438,180 shares of Costco Common Stock at an initial conversion price of $22.00.

Holders of the Notes may require the Company to purchase the Notes (at the discounted issue price plus

accrued interest to date of purchase) on August 19, 2002, 2007, or 2012. The Company, at its option, may

redeem the Notes (at the discounted issue price plus accrued interest to date of redemption) any time on

or after August 19, 2002. As of September 2, 2001, $48,123 in principal amount of the Zero Coupon Notes

had been converted by note holders to shares of Costco Common Stock.

In February 1996, the Company filed with the Securities and Exchange Commission a shelf registra-

tion statement for $500,000 of senior debt securities. To date, no securities have been issued under this

filing. On October 23, 2001, subsequent to fiscal 2001 year end, the Company filed with the Securities and

Exchange Commission to offer up to an additional $100,000 in debt securities, bringing the total amount of

debt securities registered under shelf registration to $600,000.

At September 2, 2001, the fair value of the 7.125% Senior Notes, based on market quotes, was

approximately $317,460. The Senior Notes are not redeemable prior to maturity. The fair value of the

3.500% Zero Coupon Subordinated Notes at September 2, 2001, based on market quotes, was approxi-

mately $755,615. The fair value of other long-term debt approximates carrying value.

30