Costco 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

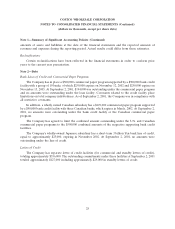

Note 1—Summary of Significant Accounting Policies (Continued)

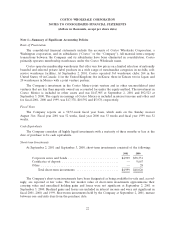

Marketing and Promotional Expenses

Costco’s policy is generally to limit marketing and promotional expenses to new warehouse openings;

occasional direct mail marketing to prospective new members and annual direct mail marketing programs

to existing members promoting selected merchandise. Marketing and promotional costs are expensed as

incurred.

Preopening Expenses

Preopening expenses related to new warehouses, major remodels/expansions, regional offices and

other startup operations are expensed as incurred.

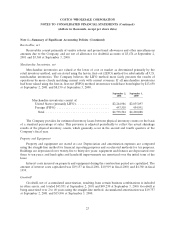

Impairment of Long-Lived Assets

The Company periodically evaluates the realizability of long-lived assets based on expected future

cash flows. In accordance with Statement of Financial Accounting Standards (SFAS) No. 121, the

Company recorded pretax, non-cash charges of $15,231, $10,956 and $31,080 in fiscal 2001, 2000 and 1999,

respectively, reflecting its estimate of impairment relating principally to excess property and closed

warehouses. The charge reflects the difference between carrying value and fair value, which was based on

estimated market valuations for those assets whose carrying value was not recoverable through future cash

flows.

Reorganization of Canadian Administrative Operations

On January 17, 2001, the Company announced plans to reorganize and consolidate the administration

of its operations in Canada. Anticipated costs related to the reorganization are estimated to total $26,000

pre-tax ($15,600 after-tax, or $.03 per diluted share), expensed as incurred in fiscal 2001 and to be incurred

in the first quarter of fiscal 2002. During fiscal 2001 the Company expensed $19,000 related to this

reorganization and consolidation process. This charge is included in the provision for impaired assets and

closing costs.

Closing Costs

Warehouse closing costs incurred relate principally to the Company’s efforts to relocate certain

warehouses that were not otherwise impaired to larger and better-located facilities. As of September 2,

2001, the Company’s reserve for warehouse closing costs was $15,434, of which $6,538 related to lease

obligations. This compares to a reserve for warehouse closing costs of $11,762 at September 3,2000, of

which $8,887 related to lease obligations.

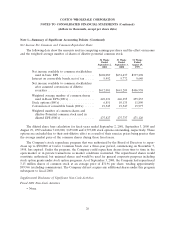

Income Taxes

The Company accounts for income taxes under the provisions of Statement of Financial Accounting

Standards (SFAS) No. 109, ‘‘Accounting for Income Taxes.’’ That standard requires companies to account

for deferred income taxes using the asset and liability method.

25