Costco 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

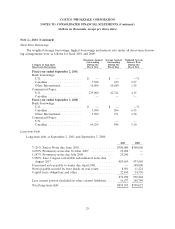

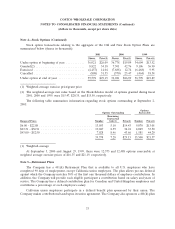

Note 4—Stock Options (Continued)

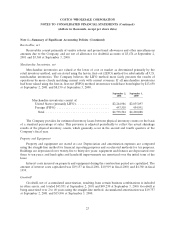

Stock option transactions relating to the aggregate of the Old and New Stock Option Plans are

summarized below (shares in thousands):

2001 2000 1999

Shares Price(1) Shares Price(1) Shares Price(1)

Under option at beginning of year ........... 36,021 $26.09 36,778 $19.89 34,604 $13.52

Granted(2) ............................ 8,822 34.18 7,501 42.76 9,106 36.90

Exercised ............................. (4,457) 14.04 (7,688) 12.74 (6,468) 9.95

Cancelled ............................. (808) 31.35 (570) 25.47 (464) 18.34

Under option at end of year ............... 39,578 $29.15 36,021 $26.09 36,778 $19.89

(1) Weighted-average exercise price/grant price

(2) The weighted-average fair value based on the Black-Scholes model of options granted during fiscal

2001, 2000 and 1999, were $15.47, $20.35, and $15.50, respectively.

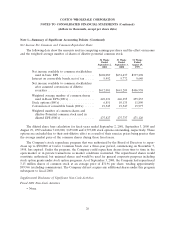

The following table summarizes information regarding stock options outstanding at September 2,

2001:

Options

Options Outstanding Exercisable

Remaining

Contractual

Range of Prices Number Life(1) Price(1) Number Price(1)

$6.00 - $22.88 .............................. 13,503 5.10 $14.43 9,870 $13.05

$23.31 - $36.91 ............................. 19,047 8.39 34.24 4,049 33.50

$43.00 - $52.50 ............................. 7,028 8.46 43.66 1,581 44.20

39,578 7.28 $29.15 15,500 $21.57

(1) Weighted-average

At September 3, 2000 and August 29, 1999, there were 12,573 and 12,488 options exercisable at

weighted average exercise prices of $16.35 and $21.19, respectively.

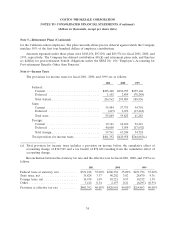

Note 5—Retirement Plans

The Company has a 401(k) Retirement Plan that is available to all U.S. employees who have

completed 90 days of employment, except California union employees. The plan allows pre-tax deferral

against which the Company matches 50% of the first one thousand dollars of employee contributions. In

addition, the Company will provide each eligible participant a contribution based on salary and years of

service. The Company has a defined contribution plan for Canadian and United Kingdom employees and

contributes a percentage of each employee’s salary.

California union employees participate in a defined benefit plan sponsored by their union. The

Company makes contributions based upon its union agreement. The Company also sponsors a 401(k) plan

33